Billionaires often pay less in taxes than many expect. They use legal methods and tax law knowledge to reduce their tax bills. This list looks at ten billionaires and how they’ve managed to avoid paying more.

Jeff Bezos

According to a ProPublica report, Bezos paid no federal income tax in 2007 and 2011, leveraging stock-based compensation and investment losses.

Elon Musk

ProPublica’s 2021 report also revealed that Musk paid little in federal income taxes relative to his wealth, mainly through borrowing against his stock holdings, thereby not realizing taxable income.

Warren Buffett

Despite his advocacy for higher taxes on the wealthy, Buffett has been noted for a low tax rate. This is largely due to his wealth being tied up in Berkshire Hathaway stock, which is not taxed until sold.

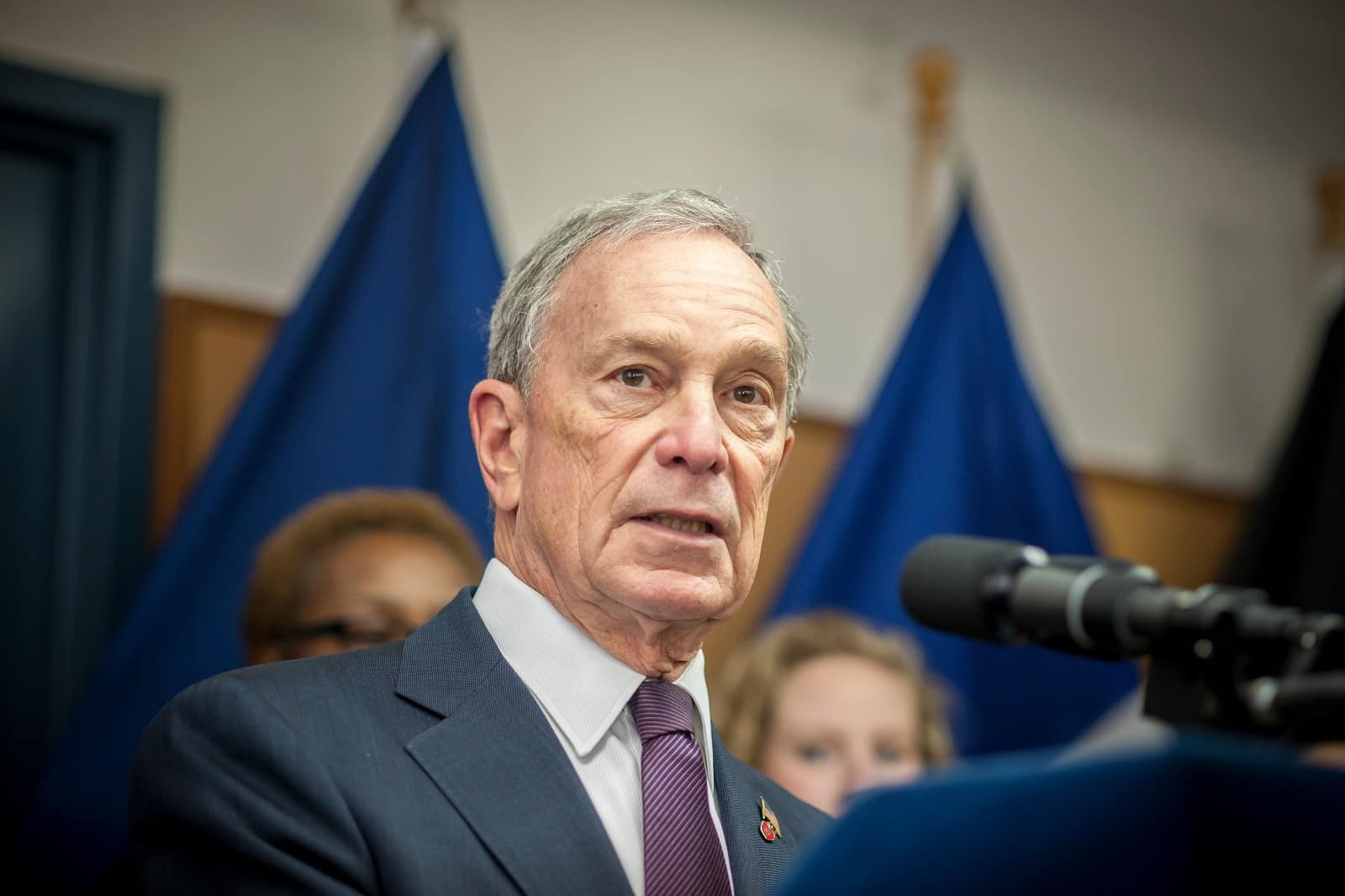

Michael Bloomberg

Bloomberg, as reported by various sources, including ProPublica, has used tax reduction strategies like charitable contributions and capital gains, which are taxed at a lower rate than income.

George Soros

Soros has been discussed in the context of billionaire tax strategies, particularly in terms of deferred interest, as noted in reports by outlets such as The New York Times.

Carl Icahn

Icahn paid no federal income tax in some recent years. His income is mainly from dividends and interest, which can be taxed differently than regular income.

Mark Zuckerberg

According to various financial analyses, Zuckerberg’s wealth comes largely from Facebook stocks, the gains of which are not taxed like regular income.

Larry Ellison

As reported by financial analysts, Ellison has been known to utilize loans against his stock holdings, a strategy that allows access to cash without triggering taxable income.

Bill Gates

Gates’s wealth management strategies involve maintaining a significant portion of his wealth in stocks, as noted in financial analyses and reports. This results in lower relative income taxation.

Phil Knight

Knight’s use of philanthropic donations and trusts as part of his tax strategy has been noted in financial reports, affecting his overall tax rate.

Are We Surprised?

Any surprises? These reports on billionaire tax strategies show that the rich often pay less tax than many people.

This raises ongoing questions about whether our tax system is fair and if it needs changing. The debate goes beyond just numbers; it’s about our society’s views on wealth and fairness.

Note: The data and evidence provided are based on reports available up to early 2023. Tax laws and individual financial circumstances can change, and the specifics may vary over time.

Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

The latest Biden administration rule on 401(k) plans is reshaping how employers manage retirement plans. It’s a complex scenario requiring a fresh understanding of fiduciary duties and provider relationships. This rule aims to protect employees but also imposes new responsibilities on employers. Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Elon Musk is calling for prosecutions after the text for a new senate bill on immigration was released. Musk accused the new bill of “enabling illegals to vote.” Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

With increasing numbers of migrants arriving in Colorado, public officials have rejected any notion of the state becoming a sanctuary for migrants and asylum seekers. Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Disney is set to appeal its refusal for a lawsuit against Ron DeSantis, who stripped the company of its rights for disagreeing with the Governor’s views on the teaching of sexual orientation in classrooms. Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

An unprecedented surge in health plan enrollments has reignited former President Donald Trump’s commitment to dismantling the program should he secure the GOP nomination once again. Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

The post 10 Billionaires’ Tax Loopholes: Why You’re Paying More While They Barely Pay at All first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / AndriiKoval.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.