Financial scams are becoming increasingly sophisticated, causing substantial monetary losses to consumers. With a range of common types to be aware of, the ongoing need for vigilance is critical to avoid falling victim to these deceptive practices.

Voice Imitation Scams: A New Frontier in Fraud

Advancements in technology have led to the emergence of voice imitation scams. Using “deepfake” software, scammers can replicate an individual’s voice, making it challenging to distinguish between genuine and fraudulent calls. These scams are part of a worrying trend that saw U.S. consumers lose over $7 billion in the first three quarters of 2023.

Grandparent Scams: Preying on Emotions

A particularly heartless form of scam is the grandparent scam, where fraudsters exploit family bonds. They impersonate a relative in distress, often claiming an urgent need for money due to an emergency. These scams have evolved with technology, using voice imitation to increase their deceitfulness.

Protecting the Elderly: A Call for Awareness

The U.S. Attorney General, Merrick B. Garland, underscores the need for heightened vigilance against elder fraud. He emphasizes the importance of pausing before sharing personal information and reporting any instances of fraud or abuse. Awareness is key in combating these emotionally manipulative scams.

Safeguarding Against Emotional Scams

Experts recommend several measures to protect against grandparent scams. These include using safe words for emergency situations, verifying unusual requests through familiar contact numbers, and discussing any suspicious calls with family members. Awareness and open communication are critical defenses against such scams.

Romance Scams: A Costly Betrayal of Trust

Romance scams have surged, exploiting individuals looking for connections on social media or dating apps. These scams typically involve fabricated emergencies or financial requests, often leading to significant monetary losses. Victims are usually asked to make untraceable payments, adding to the complexity of these frauds.

Cryptocurrency and Investment Scams: The High-Stakes Deceptions

Involving over $3.8 billion in losses, cryptocurrency and investment-related scams represent the most costly financial frauds. Scammers often use cryptocurrencies due to their lack of legal protections and the irreversible nature of transactions. These scams can manifest in various forms, including unsolicited investment advice or fraudulent celebrity endorsements.

The Cryptocurrency Minefield

To avoid falling prey to cryptocurrency scams, it’s crucial to separate online dating from investment advice. Legitimate businesses or government entities will not request payments in cryptocurrency. Awareness and skepticism are vital when dealing with unsolicited financial advice or demands for crypto payments.

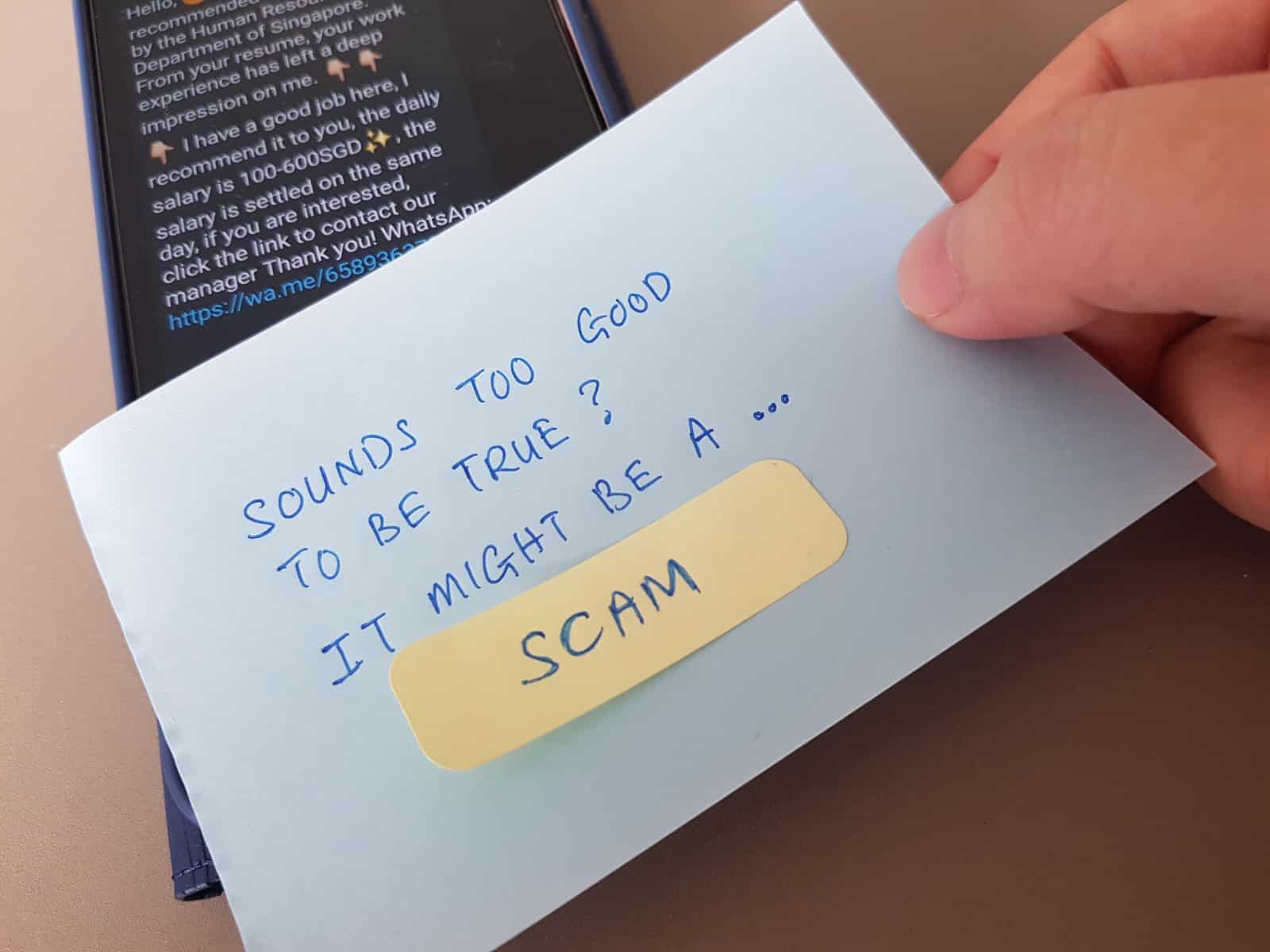

Employment Scams: The Job Offer Trap

With layoffs and other economic pressures, employment scams are increasingly prevalent. These scams often involve fake job offers, enticing victims with the promise of easy income or requiring upfront payments. Personal information obtained through these scams can lead to further financial exploitation.

Staying Clear of Employment Fraud

To avoid employment scams, research the company or individual offering the job. Be wary of unsolicited job offers, especially those requiring upfront payments or personal information. Legitimate job opportunities will not demand payment for employment.

Online Account Tax Scams: The Digital Deception

Online account tax scams involve fraudsters posing as helpful third parties offering to assist with IRS account setup. This scam can lead to false tax returns and identity theft. The IRS warns against sharing personal information with unknown entities offering such services.

Safeguarding Tax Information

To protect against tax scams, set up IRS Online Accounts personally and avoid storing sensitive financial information in email accounts. Vigilance and caution are essential when handling tax-related matters.

Immediate Actions if Scammed

If you suspect you’ve fallen victim to a scam, report it immediately to local law enforcement, the FBI, your state attorney general, AARP, and the FTC. Prompt reporting can help mitigate damage and prevent further exploitation.

A Crisis of Fraud

Kathy Stokes from AARP describes the current situation as a “crisis level” of fraud in the country. Organized gangs and sophisticated criminal enterprises are using advanced tactics to dupe victims, emphasizing the urgent need for awareness and preventive measures.

The Power of Knowledge

Research shows that being informed about specific scams significantly reduces the likelihood of engagement and loss. Sharing information and discussing potential scams with friends and family is a powerful tool in combating these fraudulent activities.

The Increasing Sophistication of Scams

The evolution of scams, particularly through the use of AI and advanced technology, makes it increasingly difficult for consumers to identify fraudulent activities. Staying informed about the latest scam tactics and maintaining a healthy skepticism is crucial in combatting increasing financial fraud.

Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

The latest Biden administration rule on 401(k) plans is reshaping how employers manage retirement plans. It’s a complex scenario requiring a fresh understanding of fiduciary duties and provider relationships. This rule aims to protect employees but also imposes new responsibilities on employers. Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Elon Musk is calling for prosecutions after the text for a new senate bill on immigration was released. Musk accused the new bill of “enabling illegals to vote.” Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

With increasing numbers of migrants arriving in Colorado, public officials have rejected any notion of the state becoming a sanctuary for migrants and asylum seekers. Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Disney is set to appeal its refusal for a lawsuit against Ron DeSantis, who stripped the company of its rights for disagreeing with the Governor’s views on the teaching of sexual orientation in classrooms. Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

An unprecedented surge in health plan enrollments has reignited former President Donald Trump’s commitment to dismantling the program should he secure the GOP nomination once again. Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

The post New Wave of Financial Scams Targets Elderly, Job Seekers, and Taxpayers first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / fizkes.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.