Alright, finance enthusiasts, 2024 is shaping up to be an exciting year in the investment world. With technology advancing at lightning speed and new markets emerging, there are a few companies that are really standing out as smart investment choices. Let’s cut through the noise and check out these potential gold mines.

NextGen Tech Innovators

This company is at the forefront of AI and machine learning technology. They’ve been making waves with their groundbreaking innovations in automation.

Why Invest: With AI becoming more integrated into every aspect of business, their growth potential is huge. They’ve consistently shown strong financial performance and are leading the charge in tech innovation.

Considerations: High-tech investments can be volatile, so it’s a play for those willing to embrace some risk for potentially high rewards.

Green Future Energy Co.

A leader in renewable energy, they’re all about solar and wind power solutions.

Why Invest: The shift towards sustainable energy sources is only getting stronger. This company has a solid track record and is well-positioned to capitalize on this global trend.

Considerations: Keep an eye on government policies and global energy trends, as these can greatly influence the renewable sector.

HealthTech Solutions Inc.

They’re revolutionizing healthcare with technology-driven solutions, from telemedicine to advanced diagnostics.

Why Invest: The healthcare sector continues to grow, especially in tech. This company has shown innovation and resilience, tapping into an ever-expanding market.

Considerations: Regulatory changes in healthcare can impact performance, so stay informed on policy developments.

EduTech Global

Pioneering in the edtech space, they’re transforming how educational content is delivered globally.

Why Invest: Education technology has seen a surge, especially post-pandemic. They’ve got a diverse product line and a growing customer base.

Considerations: Market competition is fierce in edtech, so watch for how they maintain their edge.

CyberSecure Corp

In the business of cybersecurity, providing top-notch solutions to protect digital assets.

Why Invest: As cyber threats increase, so does the demand for robust security solutions. They’ve got a strong client portfolio and innovative tech.

Considerations: Cybersecurity is a rapidly changing field, requiring constant innovation to stay ahead.

Urban Green Agriculture Ltd.

This company specializes in innovative urban farming technologies, offering sustainable, local food solutions for growing urban populations.

Why Invest: There’s a growing demand for sustainable and local food sources, and Urban Green Agriculture is well-positioned to dominate this niche market. Their commitment to eco-friendly practices is attracting both consumer and investor interest.

Considerations: Keep an eye on the evolving trends in urban farming and the competition in this sector.

Virtual Reality Ventures

A leader in virtual and augmented reality, creating immersive experiences for entertainment and education.

Why Invest: VR and AR are gaining traction across various sectors. This company is at the forefront of delivering cutting-edge immersive experiences.

Considerations: The VR/AR market is technology-driven and subject to rapid technological changes and advancements.

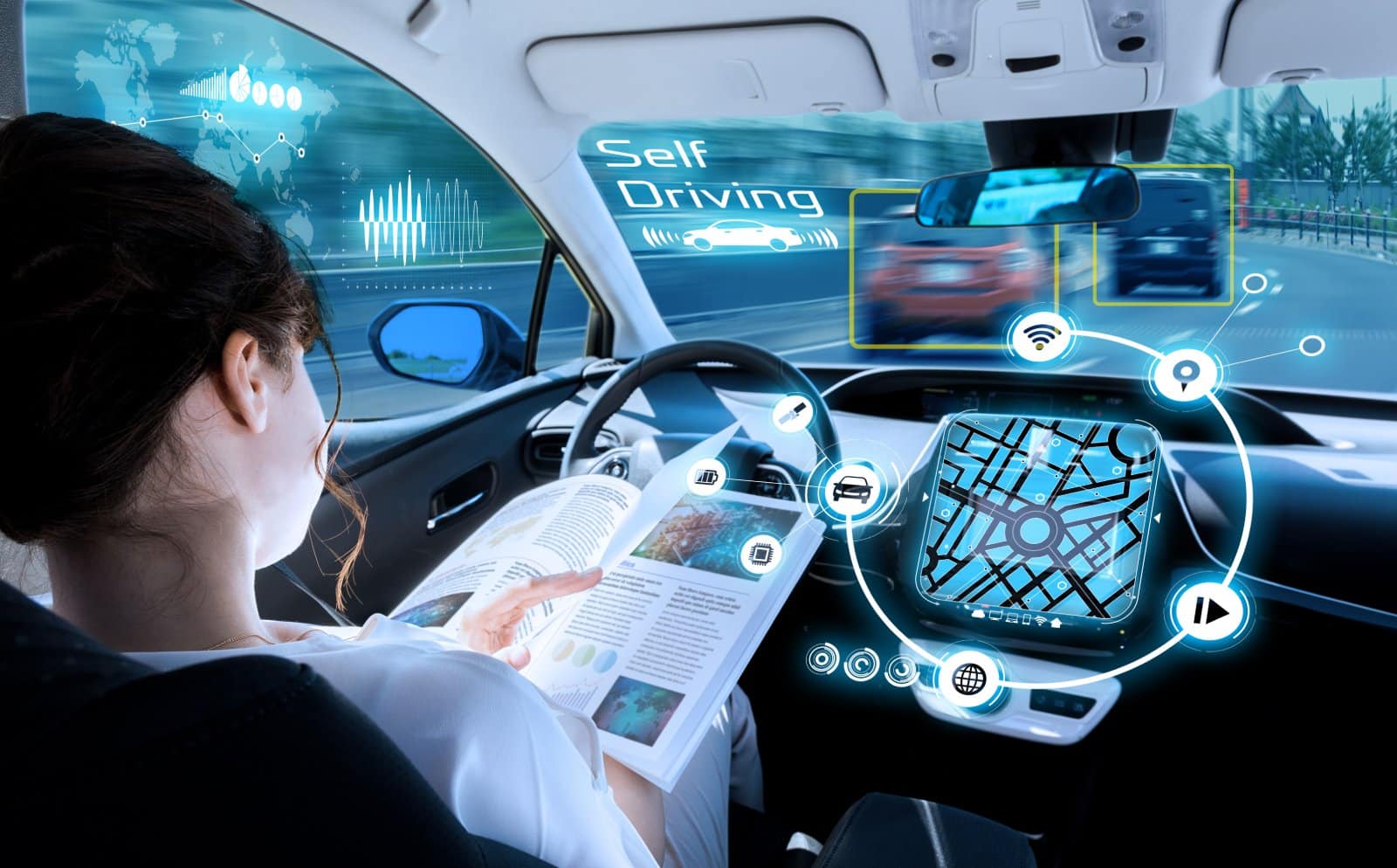

Autonomous Mobility Solutions

Focused on developing autonomous vehicle technology, they are pioneers in the field of self-driving cars and AI systems.

Why Invest: The future of transportation is heading towards autonomy, and this company is a front-runner in this transformative industry.

Considerations: Regulatory and safety challenges in the autonomous vehicle sector could impact the pace of growth and adoption.

Global FinTech Innovators

A fintech company reshaping financial services with digital payment solutions, blockchain technology, and innovative banking services.

Why Invest: The shift towards digital finance is accelerating, and Global FinTech Innovators is leading the way in the sector with robust financial technologies.

Considerations: Financial technology is highly regulated, so keep informed about global financial regulations that might affect the industry.

Ocean Blue Maritime Co.

Specializing in sustainable oceanic exploration and transportation, focusing on eco-friendly shipping solutions and marine conservation.

Why Invest: As global trade continues to expand, there’s a rising demand for sustainable maritime transport, and Ocean Blue Maritime Co. is at the forefront with its commitment to environmental consciousness.

Considerations: The maritime industry is subject to international regulations and environmental policies, which could influence the company’s operations.

2024 offers diverse investment opportunities ranging from sustainable agriculture to high-tech innovations in fintech and autonomous mobility. Each company presents unique growth prospects, but weighing the potential risks and staying updated with industry trends is important.

Remember, investing requires careful consideration and sometimes a bit of intuition, so do your homework and consider consulting a financial advisor for personalized advice.

More From Frugal to Free…

U.S. Budget Breakthrough: A Huge Step Forward Amidst Looming Shutdown Threat

Will Easing Inflation in America Continue?

The post Making Money: Companies to Invest in for 2024 first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / Gorodenkoff. The people shown in the images are for illustrative purposes only, not the actual people featured in the story.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice. For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.