Looking to start a new budget or refresh your current one? These tips can help you start off the new year with a sound financial plan so you can reach your savings goals.

Americans Look to Budgets to Stay On Track

In an economy where many Americans are feeling the effects of a tense housing market, inflation, and stagnant wages, proper budgeting is more important than ever.

Why Do Budgets Matter?

Figuring out the best way to allocate your money to make sure that your necessities are covered is one thing, but what about making room in the budget for savings or fun? With a little focus, you can create a plan for your funds that will make room for everything you want and need.

Account for Every Dollar

The secret to a great budget? Account for every single dollar. This takes some work, because you’ll need to review every month to make sure you’re not overspending in any areas, but it ultimately will help you know where your money is going.

Figure Out Your Take-Home Pay

Creating a budget starts with identifying how much money you bring home after taxes. You can look to your paycheck for this information.

Net Pay: A Starting Point

Look for the section called “net pay.” This will show you the amount of money that you’ll receive after taxes have been deducted.

List Your Expenses

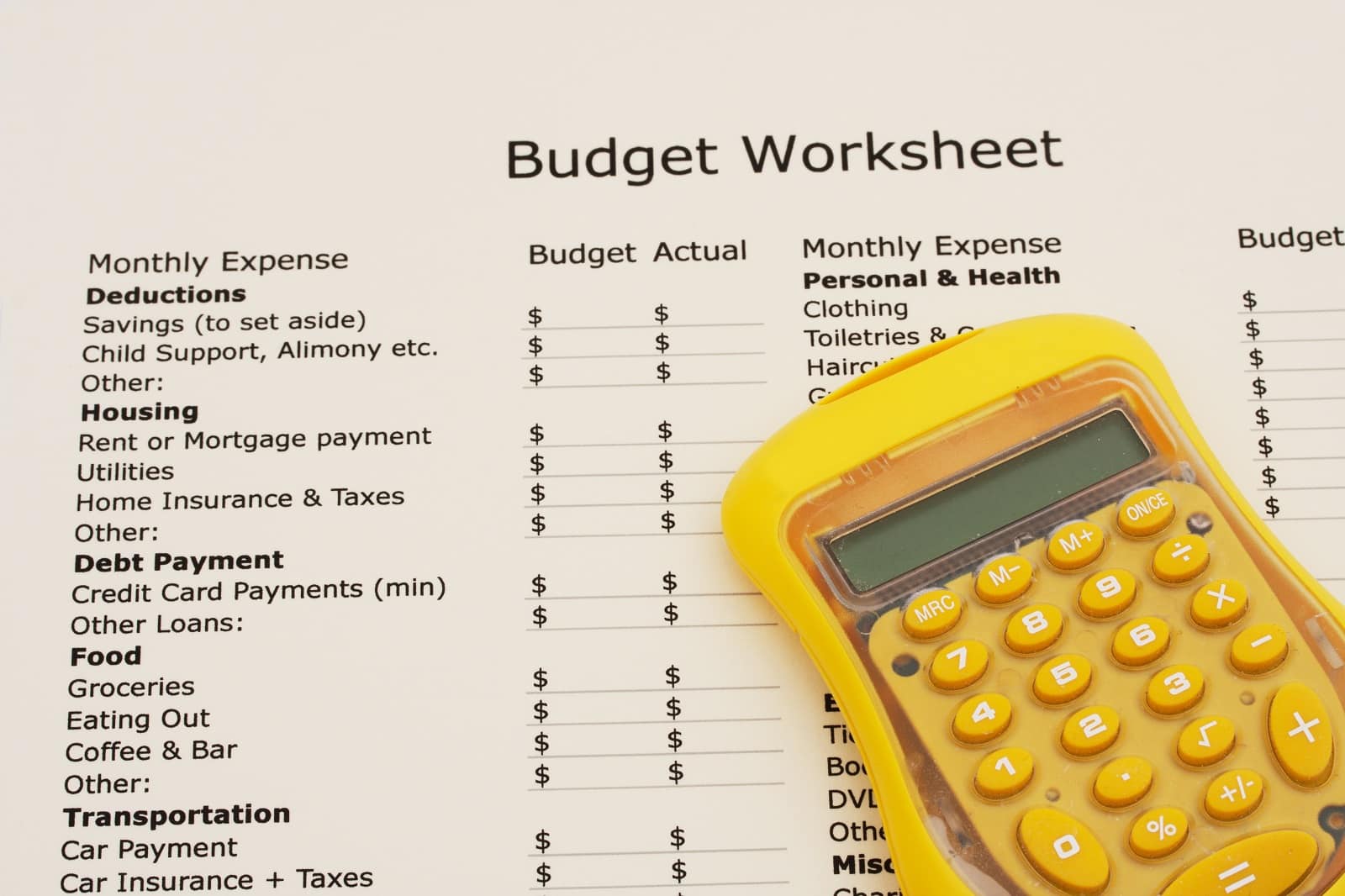

Once you’ve identified your net pay, you need to make a comprehensive list of all of your expenses. This includes things like your rent or mortgage payment, utility bills, groceries, car payments, and insurance.

Don’t Leave Out the Little Things

Don’t forget to calculate how much you spend on extras like streaming services or subscriptions! These little expenses can add up, so don’t leave them out.

A Place for Every Dollar

Let’s pretend you have a net income of $4,000 per month, and all of your expenses total $3,000 per month. That means you have $1,000 left in the budget after all of your bills are paid. You need to make sure this money also has a place in the budget as well.

What Are Your Savings Goals?

Start by setting a savings goal. Some people set aside a percentage of their income for savings. Ten or twenty percent is a good place to start, but you can make this as high or low as you’d like. Others choose a number and try to save a certain amount each month.

Every Little Bit Counts

Even if you’re only able to save $5 per week, that comes out to $260 per year. Investing as much as you can into saving for incidentals, emergencies, and the future will pay off in the long run.

Planning for Incidentals and Extras

Next, think about what other things you spend your money on. Do you go out for brunch with friends once a month? Do you go on movie dates with a partner? How often do you buy coffee on the way to work?

Using Your History to Predict Future Spending

One way to identify trends is by going through your recent bank statements and adding up how much you’ve spent on certain things over the past few months. That can help you identify how much to budget.

Budgetary Math

For example, if you’ve spent $20 per week buying coffee, then you may want to budget that in by figuring out how much it equals monthly ($20 per week, times 52 weeks in a year, equals $1,040. Divide that by 12 months, and you have about $87 per month).

How to Stay On Top of Your Budget

Budgeting for every single dollar will ensure that your coffee runs don’t end up pushing you over the limit of what you actually have to spend. If you’ve budgeted $87 per month for coffee, then you can breathe easily knowing that you can afford that cappuccino every morning.

Budgeting for Groceries

You can use this same averaging technique to figure out how to budget for groceries. Look at your bank statement to see how much money you’ve spent at grocery stores over the past few months and let that help you decide how much you need to set aside for food shopping.

When You Don’t Have a History, Look to Estimates

If you’re new to financial independence, then averaging previous expenses probably won’t work for you. It might be helpful to look at estimates for things like groceries based on the cost of food where you live, your family size, and where you shop.

Cost of Living Examples

In New York City, monthly groceries for a single person average a little under $500 per month. Meanwhile, in Arizona, groceries for a single person will run a bit under $300 per month.

Location, Location, Location

Your geographic location and cost of living matters when deciding on a budget. The cost of living varies greatly depending on where you live, so make sure you’re familiar with how much things cost in your area.

Budgeting: An Investment in Your Future

No matter how much money you make each month, you should consider creating a budget to manage it. Your wallet and your bank account will thank you (and so will your future self)!

Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

The latest Biden administration rule on 401(k) plans is reshaping how employers manage retirement plans. It’s a complex scenario requiring a fresh understanding of fiduciary duties and provider relationships. This rule aims to protect employees but also imposes new responsibilities on employers. Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Elon Musk is calling for prosecutions after the text for a new senate bill on immigration was released. Musk accused the new bill of “enabling illegals to vote.” Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

With increasing numbers of migrants arriving in Colorado, public officials have rejected any notion of the state becoming a sanctuary for migrants and asylum seekers. Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Disney is set to appeal its refusal for a lawsuit against Ron DeSantis, who stripped the company of its rights for disagreeing with the Governor’s views on the teaching of sexual orientation in classrooms. Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

An unprecedented surge in health plan enrollments has reignited former President Donald Trump’s commitment to dismantling the program should he secure the GOP nomination once again. Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

The post Budgeting Made Easy: Steps to Manage Your Money Wisely first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / Cast Of Thousands..

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.