Japanese steelmaker Nippon Steel has announced its acquisition of U.S. Steel Corp. in a monumental $14.9 billion deal. However, members of both political parties have criticized the move as a threat to national security.

Nippon Steel’s Major Move

Nippon Steel is set to pay $55 per share in cash for the acquisition of U.S. Steel, assuming all existing debts. The offer, representing a 40-percent premium to U.S. Steel’s closing stock price, has already seen U.S. Steel’s stocks rise by 25 percent.

Factors Driving the Acquisition

Currently, there’s a high domestic demand for steel. Nippon Steel is the world’s fourth-largest steel producer and explained its plans in a statement.

Targeting U.S. Cheap Energy

“Energy and manufacturing industries [will] return to the U.S. under changes in the world economy structure and cheap energy in the U.S.,” Nippon Steel said in a statement.

Nippon Steel Optimistic

“The infrastructure bill and spending are expected to drive steel demand uptick moving forward,” the statement continued, showing Nippon Steel’s optimism behind the huge deal, but on the U.S. side, there are major concerns.

Concerns and Backlash

Lawmakers from both parties expressed concerns over the acquisition, with Republican senators urging the Committee on Foreign Investment in the United States (CFIUS) to block the deal.

Calls To Block The Move

“[CFIUS] can and should block the acquisition of U.S. Steel by NSC,” said Senators Vance, Rubio and Hawley, before calling Nippon Steel “a company whose allegiances clearly lie with a foreign state and whose record in the United States is deeply flawed.”

Three Reasons to Block

They argue that the acquisition may threaten national security, shift jobs, and undermine U.S. industrial capacity.

Senators and Democrats Speak Out

Democrats, including Sen. Joe Manchin, Sen. Sherrod Brown, and Sen. Bob Casey, have called the deal, “a major blow to the American steel industry.”

“Direct Threat” to America

They also claim that it’s, “a direct threat to our national security. We must be doing everything we can to prevent any further deterioration of American ownership,” said Manchin.

Job Losses A Possibility

Union leaders, including the United Steelworkers, voiced their concerns over the deal because of violations of partnership agreements and huge potential job losses.

No Union Members Present at Meeting

Senate Banking Committee Chair Sherrod Brown criticized the lack of inclusion of union employees in decision-making, “Nippon and U.S. Steel have insulted American steelworkers by refusing to give them a seat at the table and raised grave concerns about their commitment to the future of the American steel industry.” – Sen. Sherrod Brown (D-Ohio)

Union’s Call for Closer Examination

The United Steelworkers union called the deal a violation of their agreement with management and urged government regulators to scrutinize the acquisition closely.

President of Union Speaks Out

The President of the union stressed that “We … will strongly urge government regulators to carefully scrutinize this acquisition and determine if the proposed transaction serves the national security interests of the United States and benefits workers.”

Nippon Steel’s Purchase Plan

The deal means U.S. Steel will become an unlisted company and a wholly owned subsidiary of NSC’s North American division. The finalization of the deal is expected in the second or third quarter of 2024, contingent upon shareholder and regulatory approval.

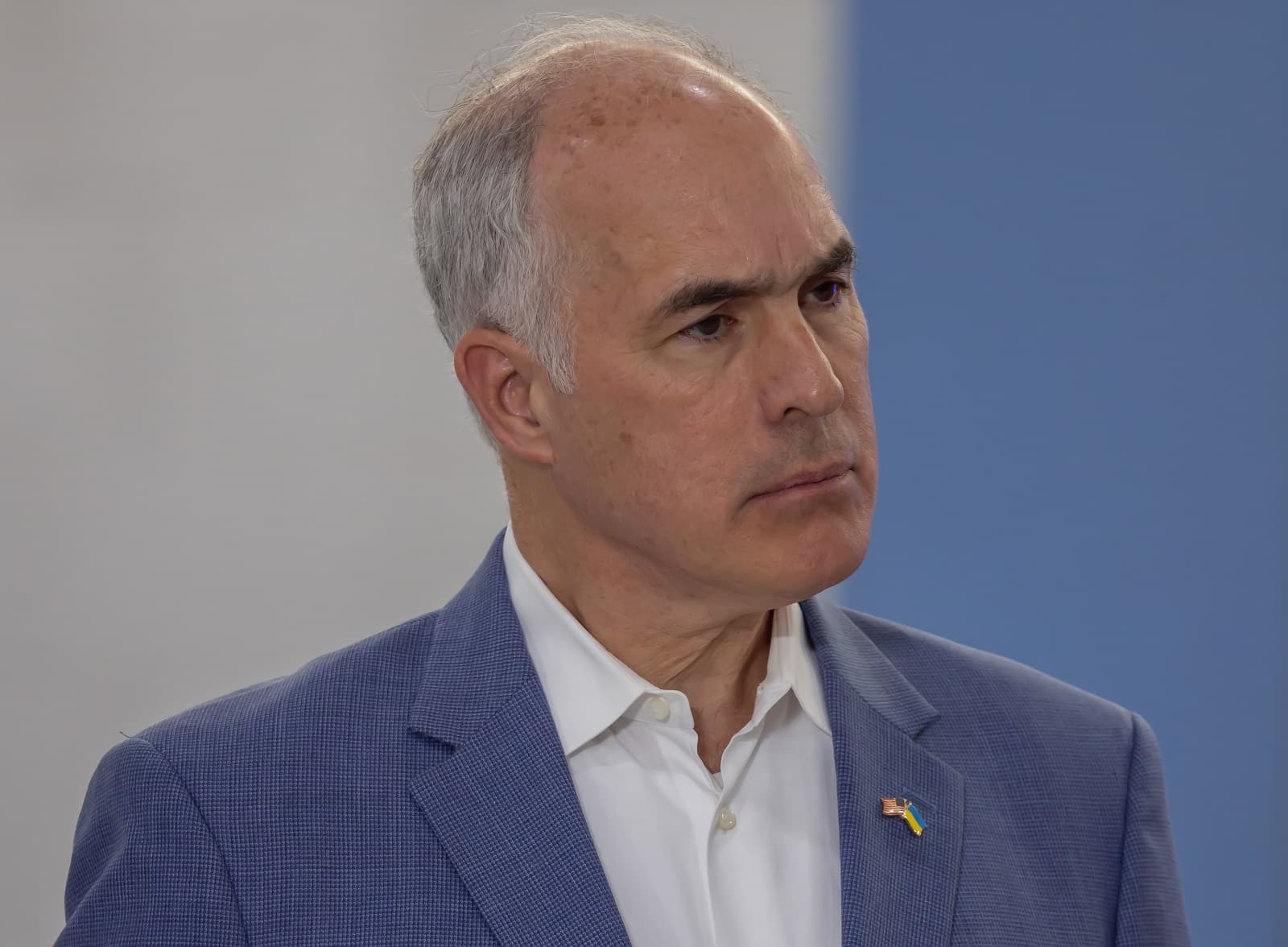

Sen. Bob Casey’s Concerns

“I’m concerned about what this means for the Steelworkers and the good union jobs that have supported Pennsylvania families for generations, for the long-term investment in the Commonwealth, and for American industrial leadership,” said Senator Bob Casey.

Senator’s Opposition

Republican senators argued that the deal prioritizes shareholder returns over broader economic implications, “The transaction was not the product of careful deliberation over stakeholder interests, but rather the result of an auction to maximize shareholder returns,” they said in a joint statement.

Concerns about Eroding American Ownership

Democrats worry about the erosion of American ownership in a vital industry. Sen. Dick Durbin expressed deep concerns, “We have U.S. Steel facilities in Illinois, and we’ve been troubled by their announcements over the past several years of reducing production. There’s something fundamentally troubling about this situation.”

The Biden Administration’s Views

National security adviser Jake Sullivan stressed the need for a strategic industrial policy at home, “Through our trilateral coordination with Japan and Korea, we are coordinating on our industrial strategies to complement one another and avert a race-to-the-bottom by all competing for the same targets.”

Estimates by World Steel Association

According to estimates by the World Steel Association industry group, the total production capacity of the combined entity would be nearly 59 million metric tons, pushing it up to the No. 3 position of global steel producers.

Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

The latest Biden administration rule on 401(k) plans is reshaping how employers manage retirement plans. It’s a complex scenario requiring a fresh understanding of fiduciary duties and provider relationships. This rule aims to protect employees but also imposes new responsibilities on employers. Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Elon Musk is calling for prosecutions after the text for a new senate bill on immigration was released. Musk accused the new bill of “enabling illegals to vote.” Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

With increasing numbers of migrants arriving in Colorado, public officials have rejected any notion of the state becoming a sanctuary for migrants and asylum seekers. Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Disney is set to appeal its refusal for a lawsuit against Ron DeSantis, who stripped the company of its rights for disagreeing with the Governor’s views on the teaching of sexual orientation in classrooms. Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

An unprecedented surge in health plan enrollments has reignited former President Donald Trump’s commitment to dismantling the program should he secure the GOP nomination once again. Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

The post National Security Threat? Nippon Steel’s $14.9 Billion U.S. Steel Buyout Raises Concerns first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / Jon Rehg.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.