A new research report shows that dozens of major U.S. companies shell out more in executive salaries than they do in federal tax.

New Analysis Stuns

According to the latest research analysis, some of the biggest companies in the U.S. pay their leading executives more in annual salaries than they pay in taxes each year.

Shedding Light on Corporate Tax

The pay data of these companies, which includes heavy hitters like Ford, Tesla, and T-Mobile, has been analyzed by the Institute for Policy Studies (IPS) and Americans for Tax Fairness (ATF).

Top Executives Win Big

Their analysis showed that between 2018 and 2022, 65 companies paid their top five executives more in annual salaries than they paid overall in federal taxes for at least two of these recorded years.

Executives Over Tax Obligations

35 of these firms paid their executives more than they paid in net taxes in every one of these five years, despite generating billions in annual revenue.

“Corporate Tax Dodgers”

The report referred to these companies as “some of the country’s most notorious corporate tax dodgers.” Information on these companies was taken from the Institute on Taxation and Economic Policy.

$9.5 Billion Salary

Between 2018 and 2022, the combined payout for executives at all 35 companies came to $9.5 billion.

The Top Ten

The ten worst offenders were Tesla, T-Mobile, Netflix, American International Group, Ford Motor, NextEra Energy, Darden Restaurants, MetLife, Duke Energy, and FirstEnergy.

Tesla Comes Out On Top

The number one worst offender was Tesla, which paid its top executives $2.5 billion over five years despite earning $4.4 billion and paying negative $1 million in taxes due to carry-over of excess losses from the previous year.

Negative Federal Income Tax Bill

The report also showed that the net federal income tax bill of all of these companies combined sat at negative $1.72 billion.

That means that these companies collectively received $1.72 billion more in government refunds over those five years than they paid in taxes.

Underpaying And Overpaying

David Kass, the executive director of Americans for Tax Fairness, has called the systematic underpayment of taxes and executive overpayments a “corporate misbehavior” that “makes working families the victims through smaller paychecks and diminished public services.”

Trump Tax Cuts

The report focused on the years 2018 to 2022 to study how the tax cuts under former president Donald Trump (which took effect in 2018) had affected corporate tax rates in the long term.

7% Drop

According to the Government Accountability Office, corporate tax rates fell from 16% in 2014 to just 9% in 2018.

Call to Congress

At the conclusion of their report, both organizations called for Congress to tackle “the entwined problems of inadequate corporate tax payments and excess executive pay.”

How to Solve the Problem

They claimed this could be done by raising the corporate tax rate, eliminating “wasteful” tax breaks, and closing legal loopholes.

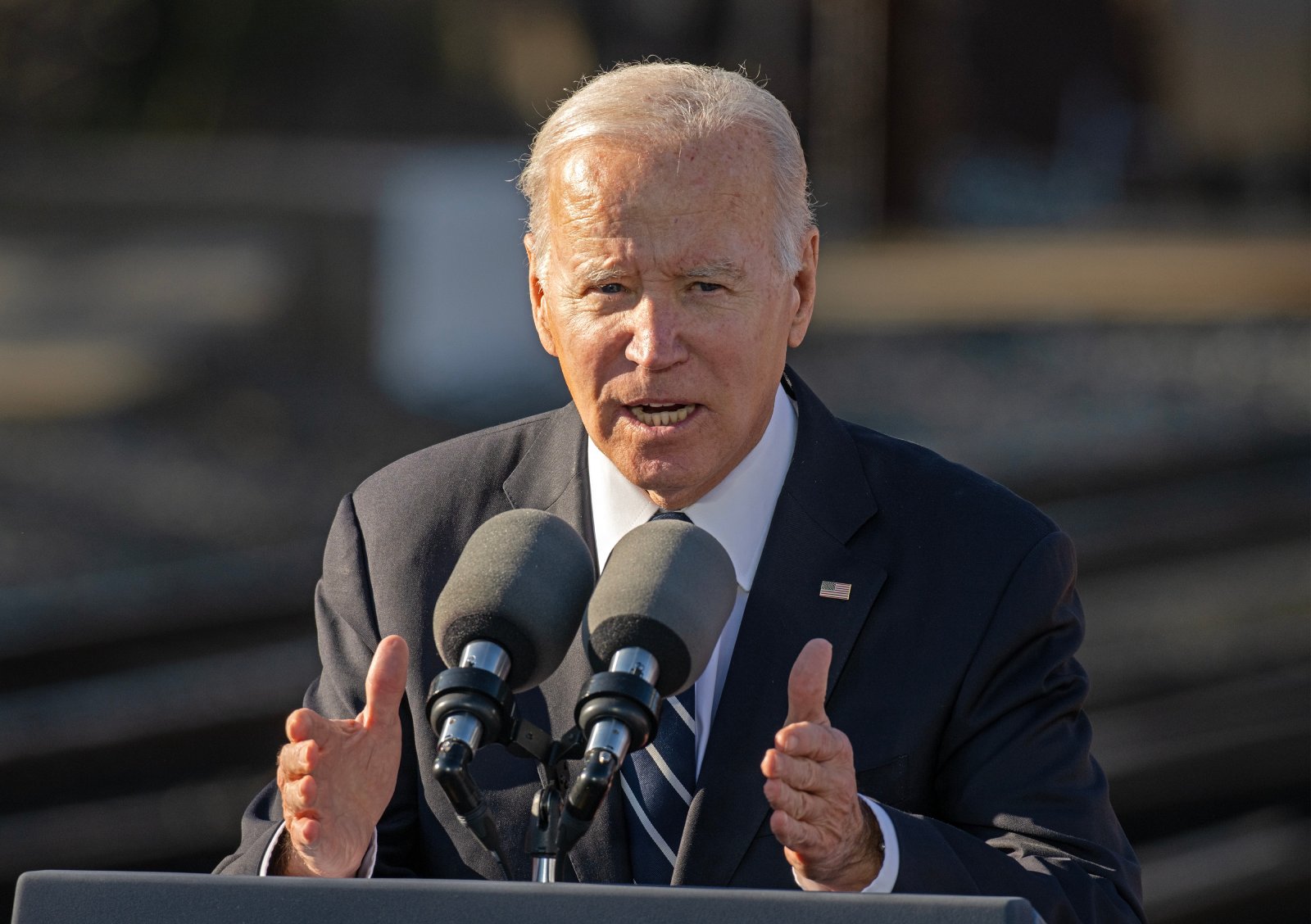

Biden Pushes for Higher Tax Rates

The report is timely, seeing as President Biden has just begun a major push toward campaigning for higher corporate tax rates, an end to corporate tax breaks, and higher taxes for wealthy individuals and households.

SOTU Address

The Biden administration’s proposed budget plan contains a corporate tax rate hike from 21% to 28%, which the president mentioned in his State of the Union address, calling for major corporations to “finally pay their fair share.”

Hard Luck in the House

However, if Biden wins a second term in office, it is still unlikely that the budget proposal will be passed through the House. Republican lawmakers, including House Speaker Mike Johnson have publicly rejected it.

Chamber of Commerce Responds

This latest corporate tax report has not escaped criticism, with the U.S. Chamber of Commerce responding directly to questions about the study.

“They Don’t Understand Our Tax System”

While Chief Policy Officer Neil Bradley had not yet seen the study, he claimed that it “sounds like something done by people with a political agenda who don’t understand how our tax system works.”

CoC CPO Explains

“Companies pay taxes on their profits after their expenses,” Bradley continued. “If a company doesn’t make a profit, or if it reinvests its earnings into building a new plant or paying employees higher wages, then there are no profits after expenses on which to be taxed.”

Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

The latest Biden administration rule on 401(k) plans is reshaping how employers manage retirement plans. It’s a complex scenario requiring a fresh understanding of fiduciary duties and provider relationships. This rule aims to protect employees but also imposes new responsibilities on employers. Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Elon Musk is calling for prosecutions after the text for a new senate bill on immigration was released. Musk accused the new bill of “enabling illegals to vote.” Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

With increasing numbers of migrants arriving in Colorado, public officials have rejected any notion of the state becoming a sanctuary for migrants and asylum seekers. Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Disney is set to appeal its refusal for a lawsuit against Ron DeSantis, who stripped the company of its rights for disagreeing with the Governor’s views on the teaching of sexual orientation in classrooms. Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

An unprecedented surge in health plan enrollments has reignited former President Donald Trump’s commitment to dismantling the program should he secure the GOP nomination once again. Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

The post Corporate Giants Prioritize Executive Pay Over Taxes, Biden’s Reform Pleas Ignored first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / Kevin McGovern.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.