Americans aged 30-49 are falling victim to investment scams more frequently than any other age group. This revelation comes from a recent FBI report that shines a light on a troubling trend in the digital age.

Increased Vulnerability Among Millennials

The FBI’s findings reveal that millennials have reported over 13,000 investment scam complaints. This demographic’s quest for financial independence has inadvertently made them prime targets for scam operations.

Wide Range of Tactics

Scammers employ a myriad of strategies, from Ponzi schemes to fake investment platforms, exploiting victims’ trust and desire for financial gain.

Ponzi Schemes

Ponzi schemes promise high returns with little risk by using new investors’ funds to pay earlier investors. This unsustainable model inevitably collapses, leaving most participants at a loss.

Pyramid Schemes

Pyramid schemes rely on the recruitment of new members to generate returns for those at the top. Unlike legitimate multi-level marketing, these schemes offer no real product or service.

Advance Fee Frauds

Scammers trick victims into paying upfront fees for services or benefits that never materialize. Often, they promise significant returns on investments or large loans.

Forex and Binary Options Scams

Unregulated or fake brokers offer opportunities in foreign exchange and binary options trading, promising huge profits. Victims often lose their entire investment to manipulated platforms.

Real Estate Scams

Fraudulent real estate investments lure victims with the promise of high returns from property flips or rental income. Often, the properties may not exist or are significantly overvalued.

Phishing for Financial Information

Scammers use phishing emails or messages to trick victims into revealing personal financial information. This data is then used for fraudulent transactions or identity theft.

Dominance of Crypto Scams

In 2023 alone, investment fraud losses soared to $4.57 billion, with cryptocurrency scams accounting for the majority. The volatile crypto market’s promise of quick returns has become a breeding ground for fraudulent activities.

Cryptocurrency’s Role in Fraud

The report links a significant part of the fraud increase to the emergence of cryptocurrencies, which are less regulated and more susceptible to manipulation than traditional financial markets.

Lesser Impact on Boomers

Contrary to common perceptions, individuals over 60 reported fewer investment scam complaints, challenging the stereotype of elderly vulnerability to financial fraud.

Surge in Complaints

The number of complaints filed with the FBI’s Internet Crime Complaint Center has nearly doubled from 2021 to 2023. The stats show an alarming increase in investment scams across the country.

Social Media’s Influence

The Federal Trade Commission highlights social media’s significant role in the spread of investment scams, with fraudsters exploiting these platforms to attract victims.

Sophisticated Scamming Techniques

Fraudsters utilize online advertisements and social media platforms to present their scams, promising high returns with minimal risk. The wide-reaching platforms ultimately catch a diverse audience.

Impersonation and False Promises

Scammers often also impersonate public figures to give their schemes a veneer of credibility, misleading victims with fabricated endorsements and unrealistic promises.

Victims’ Stories Highlight Risks

The frauds can have devastating and life-changing impacts on victims, with some individuals reporting losses of over half a million dollars.

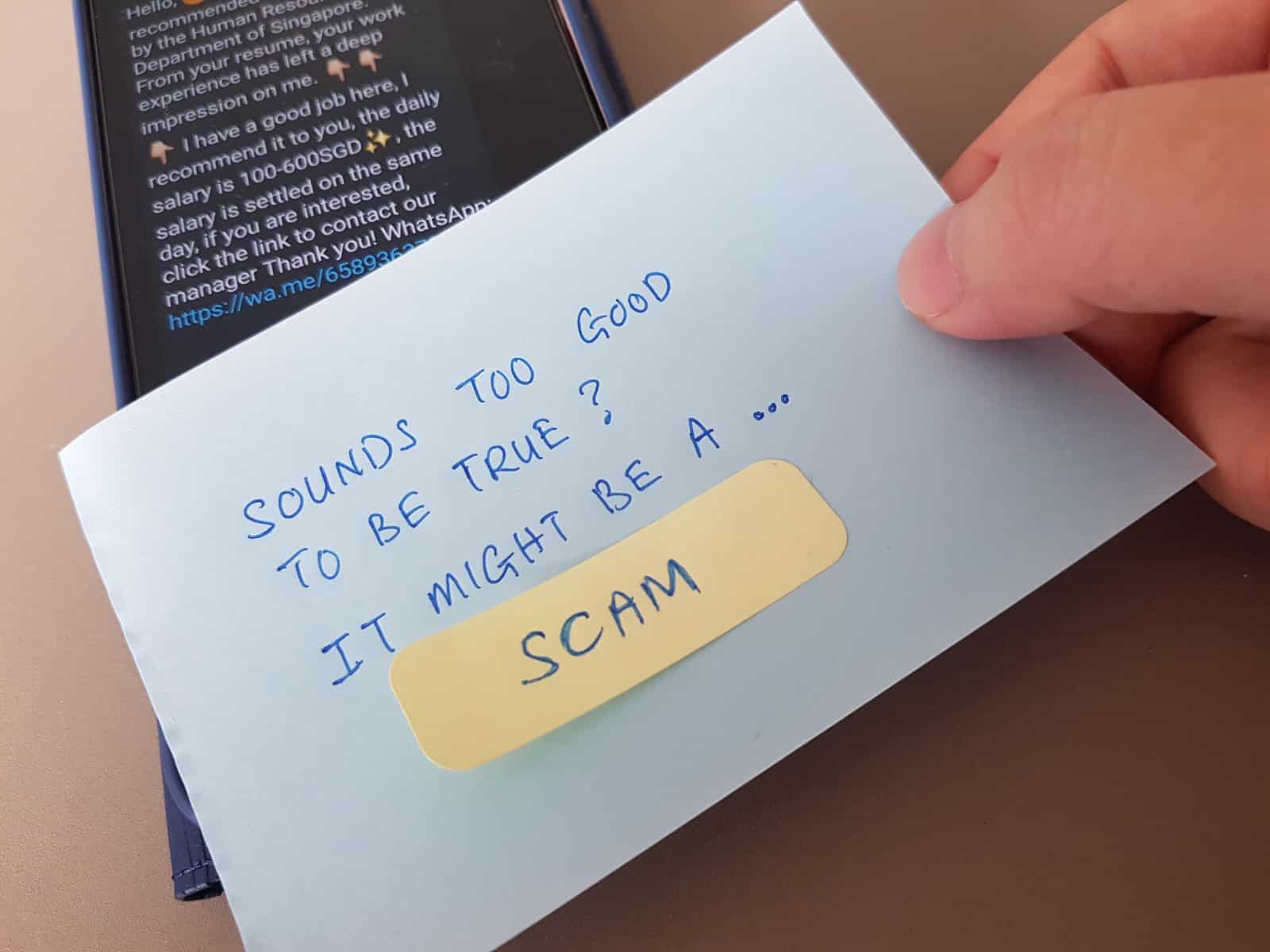

Guidance from Victims

Victims emphasize the importance of skepticism towards too-good-to-be-true investment opportunities and advocate for thorough research to avoid similar traps.

FBI’s Preventative Advice

While it sounds like common sense, the FBI recommends against transferring money or sharing financial information with unknown online entities.

Proactive Measures Against Scams

Investors need to be vigilant and proactive in protecting their assets. Armed with knowledge and some degree of caution, they can better protect their financial interests.

The Critical Need for Awareness

While regulatory bodies and financial institutions are making efforts to curb investment scams. Educating the public about the tactics and prevalence of investment scams is essential for prevention.

Focus on Legitimate Investment Avenues

Investors should also look for authentic and well-researched investment opportunities, avoiding the allure of quick gains through dubious schemes.

Stay Informed

The increasing incidence of investment scams, especially among millennials, poses a significant risk to financial security.

By adopting informed and cautious investment practices, investors can safeguard against the growing threat of financial fraud.

Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

The latest Biden administration rule on 401(k) plans is reshaping how employers manage retirement plans. It’s a complex scenario requiring a fresh understanding of fiduciary duties and provider relationships. This rule aims to protect employees but also imposes new responsibilities on employers. Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Elon Musk is calling for prosecutions after the text for a new senate bill on immigration was released. Musk accused the new bill of “enabling illegals to vote.” Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

With increasing numbers of migrants arriving in Colorado, public officials have rejected any notion of the state becoming a sanctuary for migrants and asylum seekers. Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Disney is set to appeal its refusal for a lawsuit against Ron DeSantis, who stripped the company of its rights for disagreeing with the Governor’s views on the teaching of sexual orientation in classrooms. Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

An unprecedented surge in health plan enrollments has reignited former President Donald Trump’s commitment to dismantling the program should he secure the GOP nomination once again. Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

The post Millennials Suffer from Investment Scams first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / Perfect Wave.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.