Millions of borrowers are saying no to student loan payments that have come due since the payment pause ended. Find out why these borrowers are refusing to make their payments.

40% of Student Loan Borrowers Not Paying

Close to half of all student loan borrowers who have had loan payments come due following the end of the payment pause are refusing to pay.

Servicer Errors Not Considered

While the figure may be skewed slightly because it does not account for mistakes happening on the servicer end, many borrowers have decided not to repay their loans in hopes that the Biden administration will be forgiving them.

Biden’s Forgiveness Plans

A major element of President Biden’s campaign was his student loan debt forgiveness plan, which promised to forgive between $10,000 and $20,000 of student loans for eligible borrowers.

Supreme Court Says No to Forgiveness

But in July, after the Biden administration had announced that the forgiveness would start rolling out, the Supreme Court ruled against him and declared the program unlawful.

Majority Voted Against Biden’s Plan

“The authority to ‘modify’ statutes and regulations allows the Secretary to make modest adjustments and additions to existing provisions, not transform them,” wrote Chief Justice John Roberts at the time.

Dissenters in the Minority

Justice Elena Kagan, writing her dissenting opinion, said that the states that were suing to strike down the forgiveness plan were doing so despite having “no personal stake” in the issue.

“They Think The Plan Is a Very Bad Idea”

“The plaintiffs in this case are six States that have no personal stake in the Secretary’s loan forgiveness plan,” Kagan wrote.

“They are classic ideological plaintiffs: they think the plan is a very bad idea, but they are no worse off because the Secretary differs.”

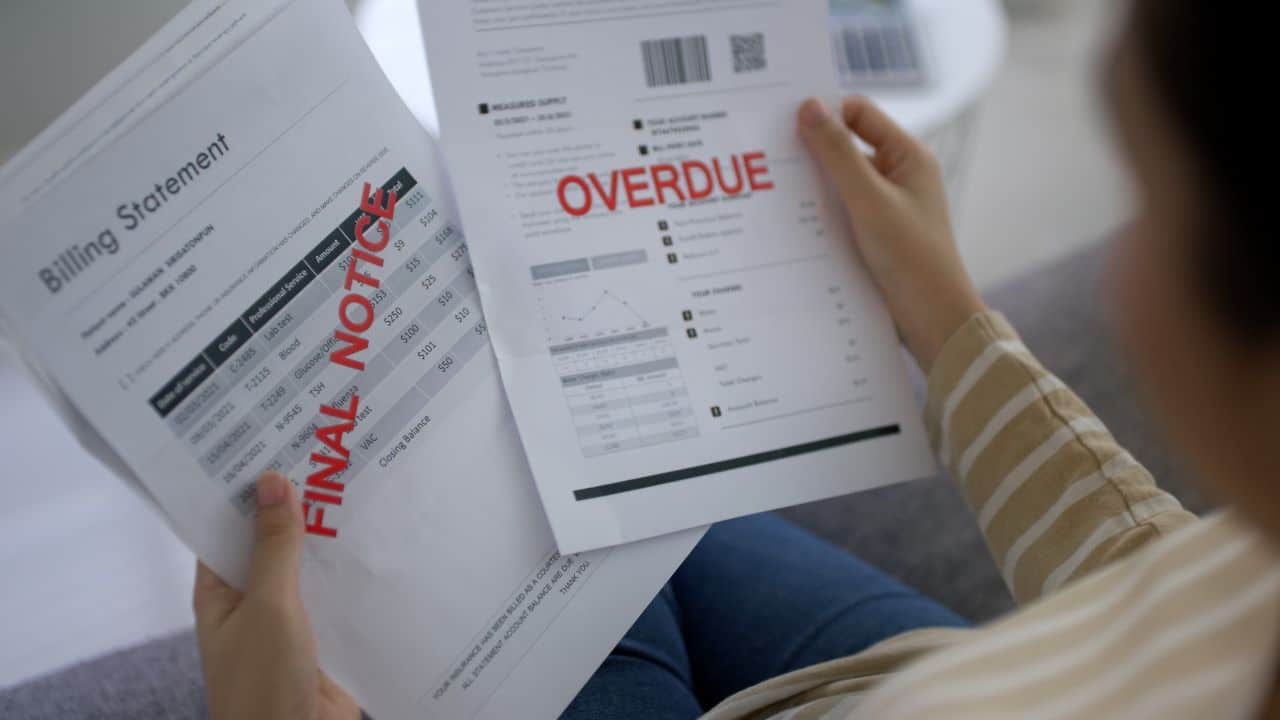

Survey Says Borrowers Can’t Afford Payments

In a survey by the Federal Reserve Bank of Philadelphia, researchers found that most borrowers simply cannot afford to resume their student loan payments now that the relief has ended.

Pandemic Payment Pause Brought Relief to Borrowers

During the pandemic, student loan payments and interest charges were paused, allowing for some breathing room for people who were struggling to make ends meet as a result of global shutdowns.

Trump Administration Used Law to Pause Payments

At the time, former President Trump issued the moratorium on student loans based on a decades-old law that gives the Secretary of Education the authority “to alleviate the hardship that federal student loan recipients may suffer as a result of national emergencies.”

Supreme Court Said Same Law Does Not Apply to Biden

That is the same law that President Biden pointed to in his forgiveness plan, but that the Supreme Court said did not apply in that case.

The Announcement to Resume

Last year, it was announced that payments and interest accruals would resume in October of 2023. Borrowers were urged to check in with their servicers to find out when and how much they’d be expected to pay.

Payment Plans for Struggling Incomes

Some people were eligible for payment plans, like the Income-Based Repayment Plan which determined the monthly payment by looking at the monthly earnings of a borrower.

If people earn under a certain threshold, they are eligible for payments as low as $0 per month.

15% of Borrowers Did Not Make the First Payment

The Federal Reserve Bank of Philadelphia’s study found that “64 percent of borrowers made at least their full scheduled payment (including a $0 payment) and another 21 percent made a partial payment in October, with 15 percent of borrowers making no payment at all.”

Some of Those Who Paid Owed $0

Notably, this figure includes those people whose payments are set at $0, so it is unclear whether that group would have made their payments if any amount had been due.

Servicing Issues at the Root of Some Missed Payments

One study revealed that roughly one-fourth of student loan borrowers didn’t pay in October because of issues on the servicing end. Many others withheld payments because they couldn’t afford them.

21% Skipped Payments Hoping for Debt Forgiveness

But a whopping 21% of borrowers who didn’t pay deliberately skipped their payment, despite having the means, under the hope that the loans would eventually be forgiven anyway.

One Year Grace Period Underway

The government is allowing for a 12-month period following the resumption of payments, during which no late fees will be assessed, and no late payments will be reported to the credit bureaus.

Many borrowers are taking advantage of this grace period.

Some Borrowers Will Pay Before Penalties Resume

Around 18% of borrowers who are not currently making student loan payments said that they plan to resume payments in September of this year, after which point there will be serious penalties for nonpayment.

Most Borrowers Making Payments are Financially Stressed

Meanwhile, 94% of those who are making payments said it is causing a financial strain each month.

21 States Where Squatters Can Legally Claim Your Property

Discover how squatters’ rights, or adverse possession, are more than just legal jargon—they’re stories of unexpected twists in the world of real estate. From sunny California to the historical landscapes of Pennsylvania, here’s how these laws could turn the tables on homeowners and squatters alike. 21 States Where Squatters Can Legally Claim Your Property

14 Things That Are Banned in the U.S. but Totally Fine Elsewhere

Ever feel like America’s rulebook was written by someone with a dartboard? Across the pond or down under, things get even wackier. Let’s take a walk on the wild side of global “Do’s” that are definite “Don’ts” in the Land of the Free. 14 Things That Are Banned in the U.S. but Totally Fine Elsewhere

25 American States Nobody Wants to Visit Anymore

Across the United States, some states capture the hearts and itineraries of many, while others remain quietly on the sidelines, overshadowed or misunderstood. These 25 states, facing what you might call a popularity crisis, are brimming with hidden wonders, cultural riches, and natural beauty, awaiting those willing to look beyond the usual tourist trails. 25 American States Nobody Wants to Visit Anymore

20 Foods That Are Cheaper to Eat Out Than Making at Home

In a world where convenience often wins, certain culinary delights come with a lower price tag when enjoyed at a restaurant rather than crafted in your own kitchen. Here are twenty foods that might save you both time and money when indulged in at your favorite eatery. 20 Foods That Are Cheaper to Eat out Than Making at Home

17 Things You’re Paying For, but You Don’t Have To

In the land of the free, there’s a price tag on everything, but savvy Americans know better than to open their wallets for just anything. Here are 17 expenses you’ve been shelling out for without realizing there’s a cheaper or even free alternative. 17 Things You’re Paying For, but You Don’t Have To

The post Freeze on Loan Repayment : Halfway to Forgiveness, Skip Payments first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / fizkes.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.