Another month has come and gone. Where is this year going? I really feel like NYE was just a second ago! Life moves pretty fast man.

Despite the time just flying by I am really glad April is over. My coaching jobs ends in two weeks, thank god. It’a huge time commitment and sucking up all my energy. I’ve also worked out a baller new schedule with my nonprofit boss, and managed to secure a slight monthly pay bump. And in two weeks I go to San Diego! Last summer was one of the toughest times of my life. I’m looking ahead to this one with much more hope and definitely more stability.This week I’m finally catching a little break. I don’t have to coach practice today or tomorrow and I’m not catering this weekend. (!!!!)

While not catering means I’m giving up at least $100 this weekend, it’s a trade off my body and mind need. I’m worn out and really need to take a break. So, my boyfriend and I are going camping Friday and Saturday nights! I’m taking a break from work, from the daily routine of my house and from being glued to my laptop and phone. I still have to coach on Sunday, but a 48 hour respite is just what the doctor ordered.

ANYWAY- back to the debt payoff! I’m happy to report that April was another good month! Even though I was let go from one job, I still had money coming in from four other sources. Continuing to live off catering leftovers and choose free or cheap entertainment options, plus getting a little birthday cash, meant that I could send another big chunk of money to my loans.

Overall I spent $4,100 on my debt this month. Typing that out I can’t believe it. Most of the time when I write these posts I’m a little surprised at how much I pay off each month. You see, as soon as a pay check hits my account I schedule a debt payment. This month I made 8 unique debt payments. That’s more than once a week! So I often don’t even realize how much I’m making because the money doesn’t stay in my account.

Taking a look back over where this money came from helps me figure out what my main streams of income are, what I spend on besides loan and where I can trim back. So, where DID that $4,100 come from?

$610– My tax refund! I got $633 back this year and I used most of it on my loans.

$1,000– A portion of my monthly coaching paycheck. I get paid every two weeks from coaching. April saw three coaching paychecks come in, which means I made payments each time. I paid $300, $500 and $200 respectively.

$57.00- The automatic deduction. I’m enrolled in autopay because I received a reduced interest rates in return for doing so. Just by signing up for autopay, each of my Navient loans interest rates dropped by .25%!

$1,933- A combination of my entire nonprofit paycheck and catering money. Some of the catering income I earned in late March but received payment for this month. I used $609.97 of catering money to wipe out the final balance on my MyCampusLoan. Paying that one off felt really good, as I wasn’t sure I was going to be able to this month.

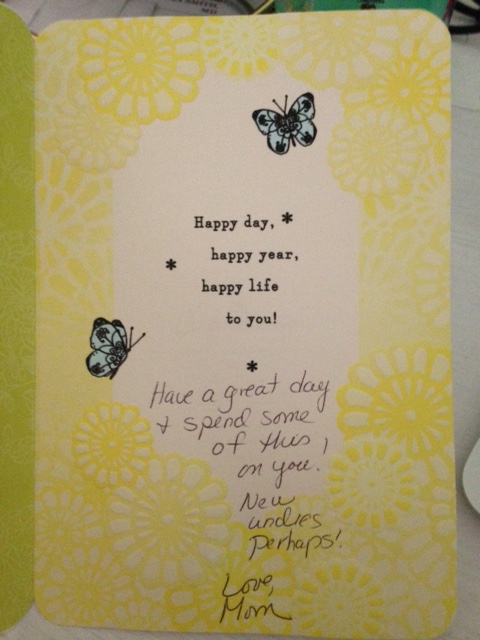

$500– I got two checks from my mother and my grandma for my birthday in early April. While my mother wrote me a little note in her card asking that I spend something on myself, every last cent went to debt payments. Spending that money on anything else would have made me feel guilty and kept me in debt for longer. So I did spend it on myself- I spent that money on my debt free future.

I got underwear in December, I don’t know what she thinks I do with them…

So with all that money sent off to kick my loans butts, I was able to pay off the remainder of the MyCampus Loan with it’s 5% interest rate. That leaves me with one loan left! And since I paid off the MyCampus Loan about midway through April, I was able to send some money this month to that final Navient loan.

My final loan is a Direct Loan through my Navient lender. It has an interest rate of 4.25% and a remaining balance of $3,179. I honestly can’t believe it. When this year started I was hoping to be able to pay off about $800-$1000 a month. I was going to really push myself to get my debt wiped out by December 2015, but I had a back-up date of February 2016.

Now I have set a goal to be debt free by the end of June. It’s going to require catering A LOT throughout May and June, which I honestly wish I didn’t have to do. However, the thought of being debt free in two months is so intoxicating, I honestly don’t know if I could keep myself from trying to reach this goal! I’m so excited about how little my total balance is right now and I’m ready to channel that excitement into work. I can’t get this close and slow down!

So there you have it folks. Another loan down and only one left to go. Stay tuned for the final countdown!

Kara Perez is the original founder of From Frugal To Free. She is a money expert, speaker and founder of Bravely Go, a feminist financial education company. Her work has been featured on NPR, Business Insider, Forbes, and Elite Daily.