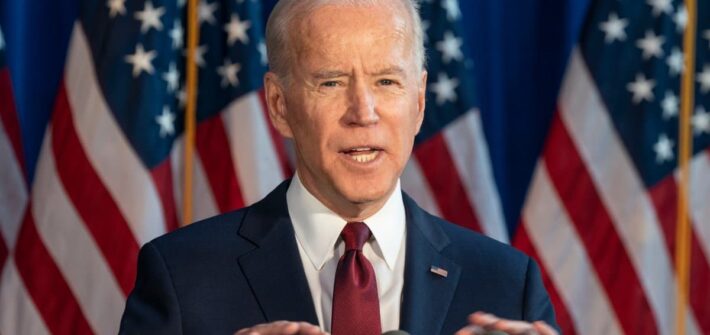

Right now, there’s a major effort from both Democrats and Republicans to push through a significant military aid package for Ukraine and its allies. President Joe Biden and some leading Senate Republicans are spearheading this initiative, emphasizing the critical need for support as Ukraine faces off against Russian aggression. House Faces a Crucial Decision After […]

Author: Mark Garro

Shohei Ohtani’s Tax Tactics in $700M Deal: Fair Play or Avoidance?

When Shohei Ohtani inked a jaw-dropping $700 million contract with the Los Angeles Dodgers, he didn’t just make sports headlines—he stirred up a tax talk that’s got everyone from fans to financial buffs tuning in. This isn’t your usual chatter about home runs and strikeouts; it’s all about the clever play behind the scenes that […]

20 Secrets of People Who Never Worry About Money

Many people fret about money around the holidays and the start of the New Year. Where will my next paycheck come from? How will I pay for presents and rent? What can I do about inflation? If those questions bog down your daily life, you might feel jealous of those cruising through their days. But […]

Is 2024 the Year for Homebuyers? Real Estate Experts Are Optimistic

Home seekers may be in for a slight reprieve in 2024 as economic trends and changing mortgage rates bring about some favorable conditions in the real estate market. Mortgage Rates Take a Turn After a period of high rates, 2024 is expected to bring some relief with mortgage rates projected to fall below 6 percent. […]

JPMorgan CEO Warns: U.S. Economy High on ‘Sugar High’ of Debt

Jamie Dimon, JPMorgan CEO, raises an alarming concern: America is dangerously high on a ‘sugar high’ of debt. He likens the current economic situation to a precarious addiction, demanding urgent attention. Pandemic and Debt Surge The pandemic era saw an enormous surge in US debt. Stimulus checks and Federal Reserve bond purchases injected trillions into […]

Citibank Faces Allegations of Discrimination in Account Closures: Legal Action Ensues

The banking sector, known for its rigorous systems and protocols, recently faced a shocking revelation. A large-scale discriminatory practice against a specific community has come to light, triggering widespread concern and legal action. This story delves into the heart of this issue, unveiling the struggles and injustices faced by numerous individuals. The Startling Discovery Major […]

State Lawmakers Target the Ultra-Rich With New Wealth Taxes

In an ambitious move to address wealth inequality and fund social programs, state legislators across the U.S. are proposing new taxes aimed at increasing the burden of the wealthiest individuals. Federal Inefficiencies This initiative, sparked by what many see as inefficiencies in the federal tax system, seeks to make multimillionaires and billionaires contribute more significantly […]

System Fails Americans’ Retirement Savings: Personal Effort Not Enough

Americans are increasingly concerned about their retirement savings, yet many Americans find themselves struggling to save adequately. Crucial Financial Stability Retirement planning is a crucial aspect of financial stability. However, with changing economic landscapes and fading pension plans, understanding the barriers and solutions to this challenge is more important than ever. Diverse Generational Goals Baby […]

Remote Work Tax Headache: Avoiding Double Taxation Across State Lines

The shift to remote work has changed more than just office locations, it is also complicating tax season for many. With a significant increase in Americans working from their living rooms, kitchens, and home offices, some employees are now facing the tax codes of multiple states. The Remote Work Rise When the pandemic hit, work […]

New Tax Package to Keep American Families Afloat and Businesses Competitive – But Is It Enough?

The U.S. House of Representatives recently passed a landmark tax package, delivering a significant policy shift aimed at supporting American families and businesses. A $78 Billion Package The Tax Relief for American Families and Workers Act of 2024, valued at $78 billion, will provide extensive support through expanded child tax credits and revived business […]