Calls for members of Congress to be banned from trading stock are growing, following a new report that detailed how lawmakers made more than $1 billion in trades in 2023, with a huge profit of over 239%. Let’s take a look at the details.

Congressional Corruption

A new campaign to ban Congress members and their closest family members from owning or trading stocks is picking up steam.

Unusual Whales and RepresentUs

RepresentUs, an organization that investigates corruption, and Unusual Whales, a stock tracking organization that regularly posts details of trading moves and profits of congress members, have teamed up to pass the ETHICS Act – Ending Trading and Holdings in Congressional Stocks.

Fighting for Market Transparency

The CEO of Unusual Whales explained their stance, “Unusual Whales was started to fight for market transparency and provide affordable market tools for all. Since then, we’ve grown to fight against political corruption.”

The ETHICS Act

The ETHICS Act has been introduced with some minor support, but it will need a great deal more to make its way into legislation.

The STOCK Act

While you might be thinking that legislators are bound by the STOCK Act (Stop Trading on Congressional Knowledge), which was established in 2012 to prevent insider trading, experts argue it’s under-enforced with lax penalties.

$200 Fines Not Enough

Indeed, if lawmakers are found to have broken the rules, they’re slapped with a $200 fine, which pales in comparison to the amount of money they’re making.

Widespread Violations

There’s also evidence that fines are widespread across party lines and consistently left unpaid. That’s why this new campaign wants to ban legislators and their families from both trading and owning stock.

The Critical Role of Transparency

The campaign’s website states, “In order for our government to function, voters need to trust that lawmakers have their best interests at heart. Right now, we all know the trust just isn’t there. One major reason why is that we continue to allow members of Congress to trade stocks while in office – with little oversight and accountability.”

A Conflict of Interest?

While lawmakers aren’t being accused of committing crimes, there is speculation about widespread insider trading and members voting for bills that would affect their portfolios.

Meteoric Rise

Many lawmakers have seen a meteoric rise in their stock portfolio in the last year alone.

Outperforming the Stock Market

Reports indicate that 33% of traders in Congress outperformed the S&P500, a stock market index that measures the performance of 500 of the largest companies listed on stock exchanges in the United States.

Beating the Odds

This is a huge figure if you account for the fact that the S&P500 has an average return of 8-10% if you’re a dedicated trader.

Savvy Investors

In fact, one study found that in the period between 2009 and 2019, 78–97% of actively managed stock funds failed to beat the S&P500, as well as 89%of large-cap U.S. funds, which are typically run by investment professionals. There are clearly some very savvy investors in Congress.

Democrats vs. Republicans

Democrats beat Republicans both in the volume of trades and performance. House Democrats made over 7000 transactions, while Republicans only made around 3000.

The Success Story of Stock Trading

Nancy Pelosi is one of the biggest dark horses when it comes to stock trading. Since 2019, she’s made around $100 million playing the market, and last year, she had returns of around 65% – smashing the general market average.

Brian Higgins’ Lucky Investments

Then we have New York’s Brian Higgins who’s lucky investments netted him a huge 238% return on his investments last year.

A Massive 238% Return

Most of his returns came from stocks in Nvidia and Meta, which he’d held since 2021. Higgins’ massive returns made him the highest-performing trader in Congress in 2023.

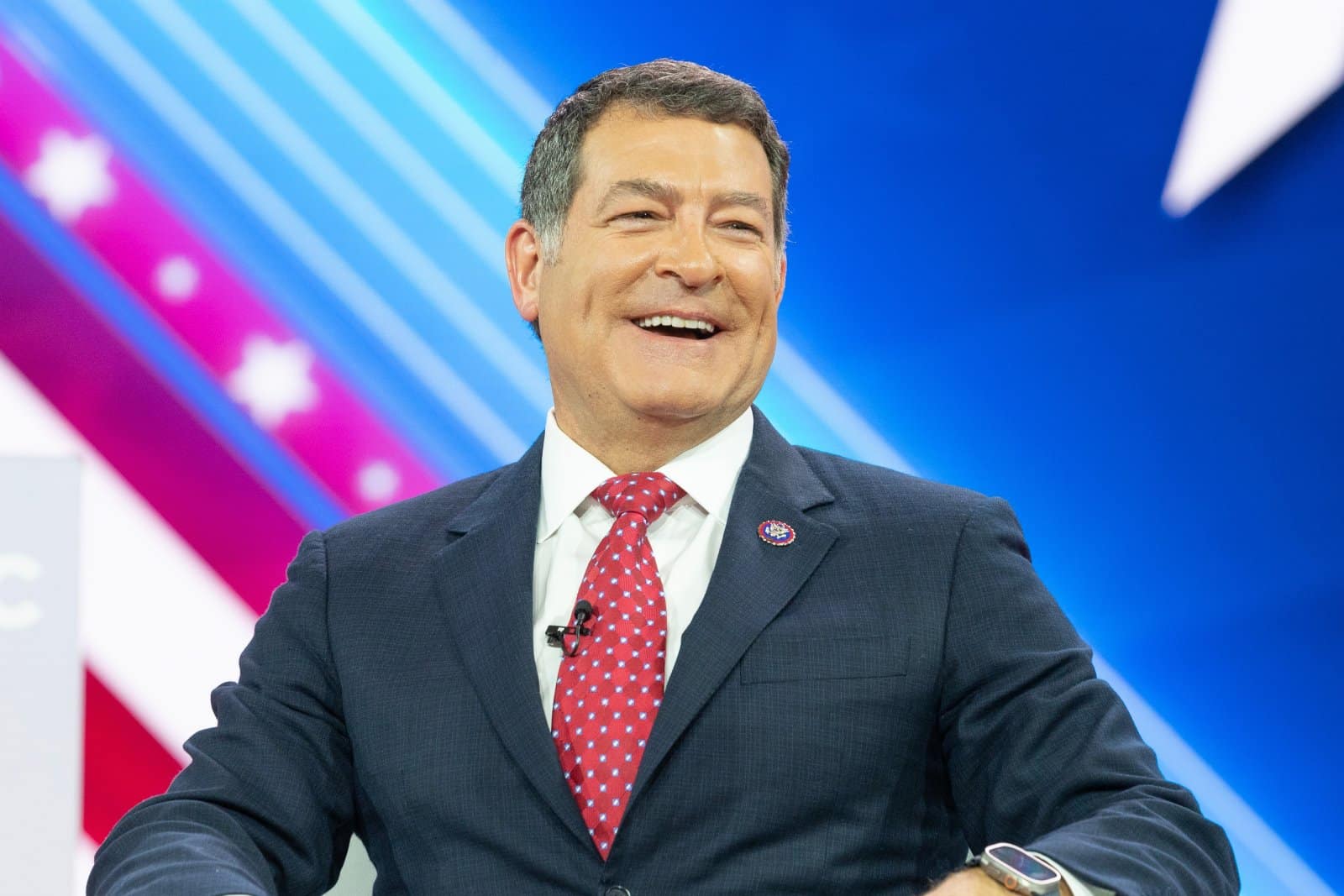

Mark Green’s Controversial Investments

Republican Mark Green had a huge 122% return on his investments, and Unusual Whales has indicated that he tried to make these returns by betting against “the U.S. itself.”

Green bet against the performance of the S&P500 – a process known as shorting.

Trading Trends

Despite all these gains, trading in Congress was down 33% on previous years.

While that might not seem like a huge figure, critics are concerned about lawmakers trading stock in companies that are related to their committee work.

Calling Out Congressional Corruption

Whether the ETHICS Act will get through Congress remains to be seen, but the bill’s sponsor, Jeff Merkley, had this to say, “Congressional stock trading is deeply corrupt. We are elected to serve the public, not our portfolios. And no member should vote on bills biased by the character of their holdings.”

Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

The latest Biden administration rule on 401(k) plans is reshaping how employers manage retirement plans. It’s a complex scenario requiring a fresh understanding of fiduciary duties and provider relationships. This rule aims to protect employees but also imposes new responsibilities on employers. Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Elon Musk is calling for prosecutions after the text for a new senate bill on immigration was released. Musk accused the new bill of “enabling illegals to vote.” Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

With increasing numbers of migrants arriving in Colorado, public officials have rejected any notion of the state becoming a sanctuary for migrants and asylum seekers. Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Disney is set to appeal its refusal for a lawsuit against Ron DeSantis, who stripped the company of its rights for disagreeing with the Governor’s views on the teaching of sexual orientation in classrooms. Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

An unprecedented surge in health plan enrollments has reignited former President Donald Trump’s commitment to dismantling the program should he secure the GOP nomination once again. Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

The post Congress Members Pocket Over $1 Billion from Trades, Fueling Call for Stock Trading Ban first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / Becky Wright Photography.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.