Billionaires often pay less in taxes than many expect. They use legal methods and tax law knowledge to reduce their tax bills. This list looks at ten billionaires and how they’ve managed to avoid paying more.

Jeff Bezos

According to a ProPublica report, Bezos paid no federal income tax in 2007 and 2011, leveraging stock-based compensation and investment losses.

Elon Musk

ProPublica’s 2021 report also revealed that Musk paid little in federal income taxes relative to his wealth, mainly through borrowing against his stock holdings, thereby not realizing taxable income.

Warren Buffett

Despite his advocacy for higher taxes on the wealthy, Buffett has been noted for a low tax rate. This is largely due to his wealth being tied up in Berkshire Hathaway stock, which is not taxed until sold.

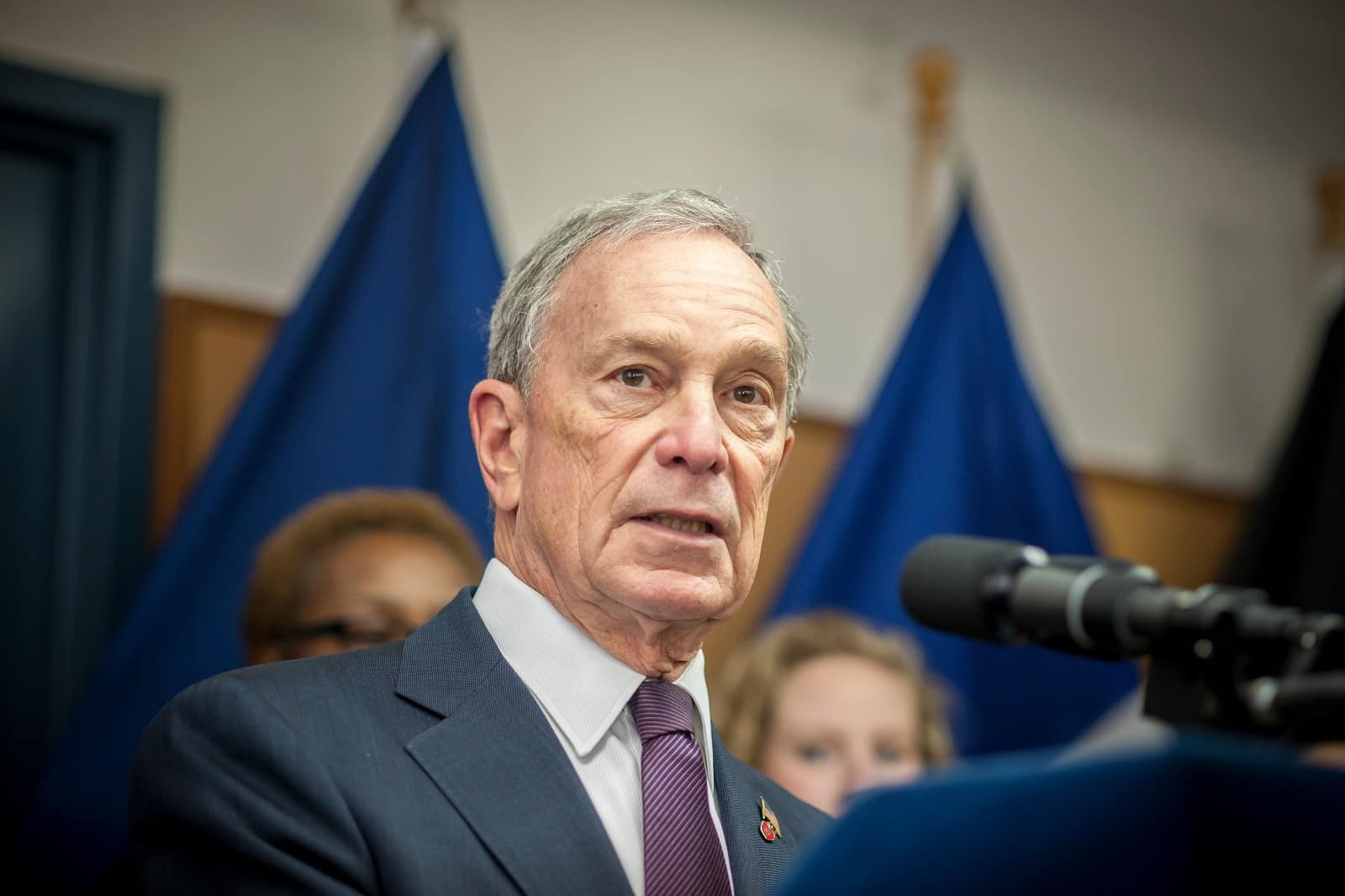

Michael Bloomberg

Bloomberg, as reported by various sources, including ProPublica, has used tax reduction strategies like charitable contributions and capital gains, which are taxed at a lower rate than income.

George Soros

Soros has been discussed in the context of billionaire tax strategies, particularly in terms of deferred interest, as noted in reports by outlets such as The New York Times.

Carl Icahn

Icahn paid no federal income tax in some recent years. His income is mainly from dividends and interest, which can be taxed differently than regular income.

Mark Zuckerberg

According to various financial analyses, Zuckerberg’s wealth comes largely from Facebook stocks, the gains of which are not taxed like regular income.

Larry Ellison

As reported by financial analysts, Ellison has been known to utilize loans against his stock holdings, a strategy that allows access to cash without triggering taxable income.

Bill Gates

Gates’s wealth management strategies involve maintaining a significant portion of his wealth in stocks, as noted in financial analyses and reports. This results in lower relative income taxation.

Phil Knight

Knight’s use of philanthropic donations and trusts as part of his tax strategy has been noted in financial reports, affecting his overall tax rate.

Are We Surprised?

Any surprises? These reports on billionaire tax strategies show that the rich often pay less tax than many people.

This raises ongoing questions about whether our tax system is fair and if it needs changing. The debate goes beyond just numbers; it’s about our society’s views on wealth and fairness.

Note: The data and evidence provided are based on reports available up to early 2023. Tax laws and individual financial circumstances can change, and the specifics may vary over time.

More From Frugal to Free…

U.S. Budget Breakthrough: A Huge Step Forward Amidst Looming Shutdown Threat

Will Easing Inflation in America Continue?

The post — first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / catwalker. The people shown in the images are for illustrative purposes only, not the actual people featured in the story.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice. For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.