A homebuyer assistance program in California provides a down payment to some people who are purchasing homes, but there’s a caveat that buyers should be aware of.

CalHFA Dream for All Initiative Returns

California has reintroduced a program that initially started in 2022. This homebuyer assistance, conceived by Senator Toni G. Atkins, offers a loan to qualified buyers through the California Housing Finance Agency to cover up to 20% of their down payment or closing costs.

A Loan, Not a Grant

The program should not be confused with other state housing finance agency programs that often provide grants to homebuyers that do not need to be repaid.

The California Dream For All Shared Appreciation Loan Program has its own specific set of rules.

What Does the Dream for All Program Offer?

Under the Dream for All program, first-time homebuyers can apply for up to 20% of the price of the home (up to a total of $150,000). This acts as a secondary loan on the property.

Eligibility Requirements

Applicants must meet a strict set of requirements for the program.

The Fine Print

The Dream for All program is an excellent resource for hopeful homeowners who can afford their mortgage payments but need assistance with the capital for a down payment and closing costs.

However, those who wish to utilize the program should be aware of a very important condition.

What’s the Catch?

Once homeowners decide to sell their homes, 20% of their profits must be returned to the California Housing Finance Agency. This means owners will pay back more than they borrowed.

Loan Amount Must Be Repaid Regardless of Home’s Value

It’s also important to note that whether the home’s value increased or not, the initial borrowed amount still has to be repaid.

The Impact On Equity

Many homeowners rely on their home’s equity when they sell so that they will have a down payment to use for their next home purchase.

Since experts agree that appreciation is slowing, there is a good chance that once the program’s share of the profits has been surrendered, homeowners will have little left for themselves.

The Brainchild of a Senator

According to Senator Toni Atkins, $220 million was awarded in the state’s budget for the Dream for All program. Last year, at its inception, the program received $300 million.

Statement Gives Details on Program

The senator released a statement describing how the funds would be utilized.

First-Time, Low-Income Borrowers Prioritized

“This next round of funding will target first-generation homebuyers, with an equitable distribution to different regions of the state, and will prioritize homebuyers in the lower tiers of income eligibility,” Atkins’ statement read.

Limited Spots Available

The program has limited funds, and the California Housing Finance Agency expects to issue these loans to up to 2,000 borrowers for this year.

The Profit-Share Plan

While the initiative does require a share of the profits to be returned to the state at the time the property is sold, the state will only take 15-20% of the profit in addition to the original amount that was borrowed.

Income-Based Repayment

The percentage of the profit that has to be paid back depends on the homeowner’s income, so those who make less will be required to pay less back.

Website Gives Additional Information

The California Housing Finance Agency provides specific examples on its website to explain how repayment would work.

There are two scenarios broken down: one for moderate-income borrowers and one for low-income borrowers.

Moderate-Income Applicants

For moderate-income borrowers, the program will issue a loan for 20% of the price of the home (up to $150,000 total).

Once the homeowner decides to sell, they will pay back the amount they borrowed from the California Housing Finance Agency as well as 20% of the appreciated value.

Low-Income Applicants

For lower-income borrowers whose income is 80% or less than the area’s median income, the program works the same way, except that they will only have to pay the original borrowed amount and 15% of the appreciated value.

Consulting an Expert

Applicants of the Dream for All program should speak with an approved lender who can help determine which category applies.

Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

The latest Biden administration rule on 401(k) plans is reshaping how employers manage retirement plans. It’s a complex scenario requiring a fresh understanding of fiduciary duties and provider relationships. This rule aims to protect employees but also imposes new responsibilities on employers. Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Elon Musk is calling for prosecutions after the text for a new senate bill on immigration was released. Musk accused the new bill of “enabling illegals to vote.” Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

With increasing numbers of migrants arriving in Colorado, public officials have rejected any notion of the state becoming a sanctuary for migrants and asylum seekers. Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Disney is set to appeal its refusal for a lawsuit against Ron DeSantis, who stripped the company of its rights for disagreeing with the Governor’s views on the teaching of sexual orientation in classrooms. Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

An unprecedented surge in health plan enrollments has reignited former President Donald Trump’s commitment to dismantling the program should he secure the GOP nomination once again. Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

The post California Home Sellers Will Have to Share Profits in New Assistance Program first appeared on From Frugal to Free.

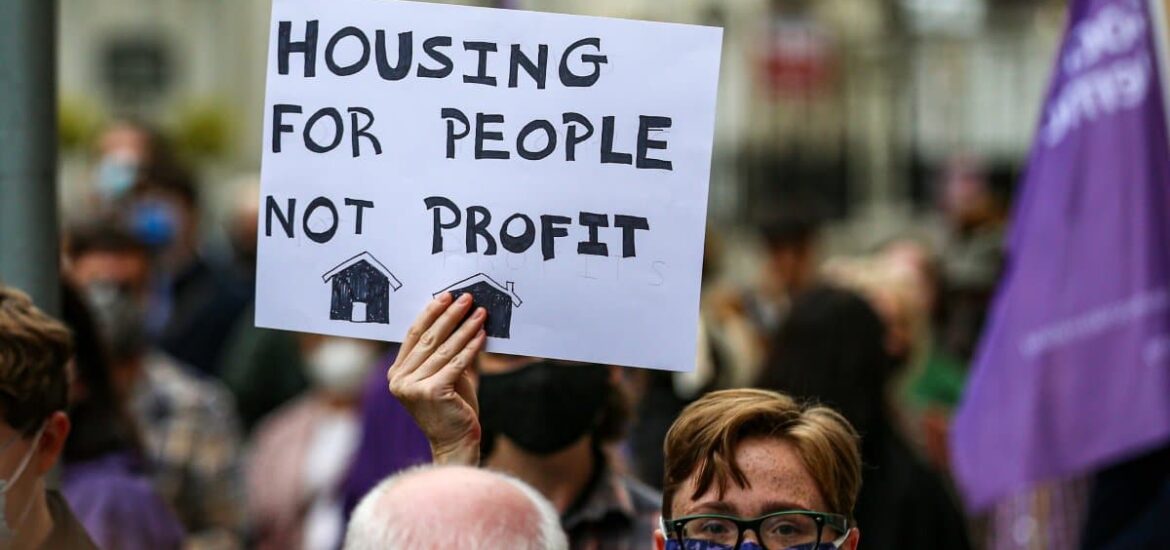

Featured Image Credit: Shutterstock / Damien Storan.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.