It was revealed that the U.S. national debt has exceeded $34 trillion and is expected to rise in the trillions over the coming decades, with politicians blaming each other instead of coming up with solutions.

$34 Trillion National Debt

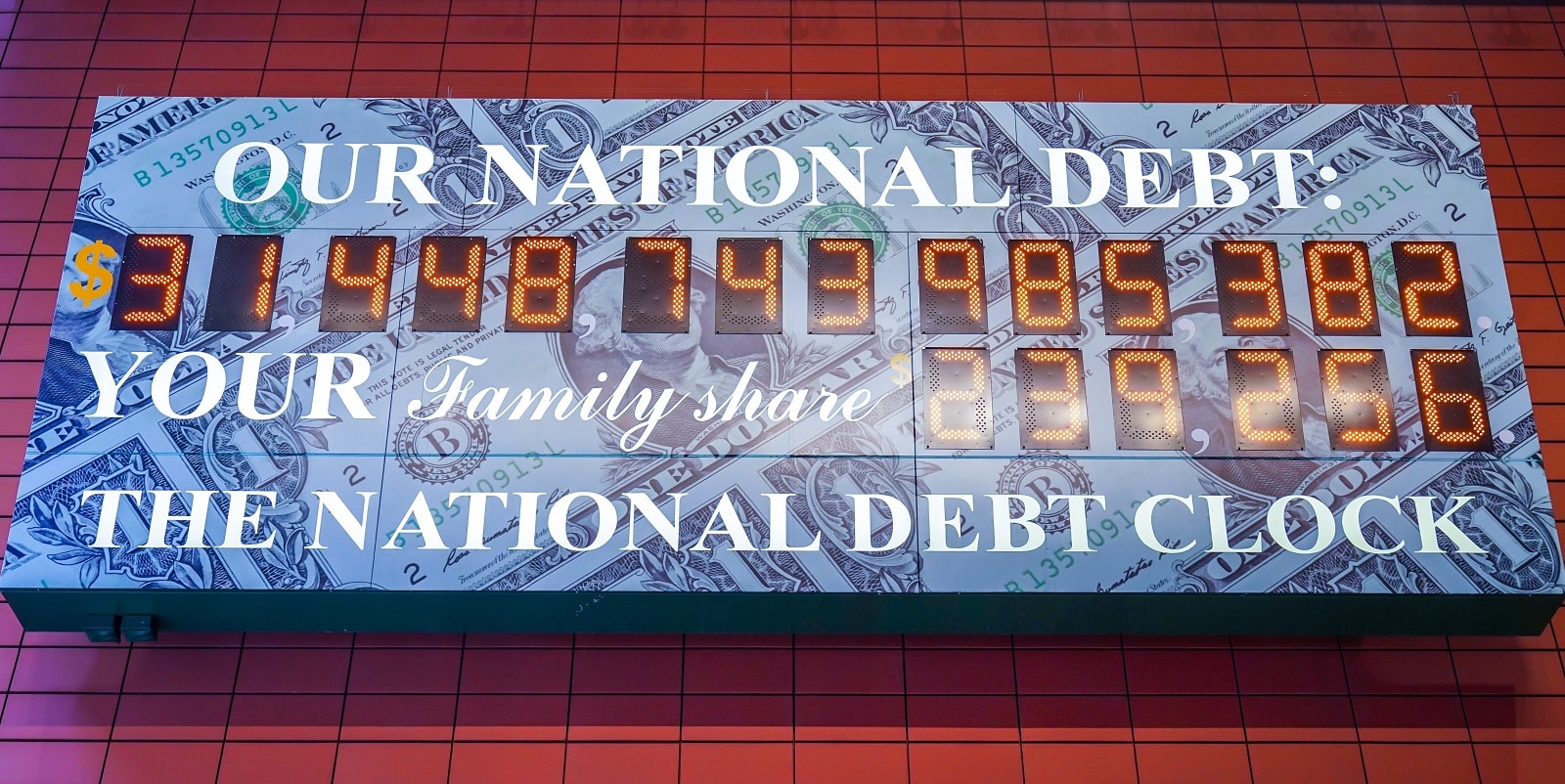

The U.S. national debt has reached an unprecedented $34 trillion, a historic high according to U.S. Treasury data.

This has put pressure on political leaders to prioritize reducing government spending and adopt measures that promote fiscal responsibility.

Understanding the National Debt

As of now, the debt stands at double its 2014 value and is projected to nearly double again in the next three decades, according to data from the Congressional Budget Office (CBO).

Debt On “Unsustainable Path”

Michael Peterson, CEO of the Peter G. Peterson Foundation, stressed that the debt should serve as a warning sign for policymakers, “We are beginning a new year, but our national debt remains on the same damaging and unsustainable path,” he said.

Increase in the Trillions

The rapid increase from $32 trillion in June to $34 trillion now, coupled with projections of an additional $1 trillion in borrowing by March, demands immediate attention, “we quickly crossed $32 trillion in June, $33 trillion in September, and now we are soaring past $34 trillion,” Peterson stressed.

Trajectory to “Skyrocket”

“Looking ahead, debt will continue to skyrocket as the Treasury expects to borrow nearly $1 trillion more by the end of March,” Peterson revealed.

A Flashing Red Signal

“Adding trillion after trillion in debt, year after year, should be a flashing red warning sign to any policymaker who cares about the future of our country,” Peterson warned.

Structural Drivers of Debt

Peterson explained that the rise in debt can be attributed to certain aspects of society, “debt rises unabated because of well-known, structural drivers” he said.

The Structural Drivers In Question

These “structural drivers” include an “aging population, high healthcare costs, rising interest costs, and a tax system that doesn’t fund what we’ve promised,” according to Peterson.

Doubling Debt and Beyond

The CBO also projected that the national debt, already at 98 percent of GDP by the end of 2022, will skyrocket to a record 181 percent of American economic activity by 2053.

Maya MacGuineas’ Glimmer of Hope

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, provided a glimmer of hope, calling 2023 “a good year for fiscal responsibility.”

The Good News In Question

MacGuineas noted “a net $1.3 trillion improvement in the ten-year deficit picture, largely thanks to the bipartisan Fiscal Responsibility Act (FRA).” But what does this mean for the economy?

Easing The Rise In Debt

MacGuineas called this “a decent down payment on the much-needed deficit reduction it will take to stem the rise in our national debt.”

A Risk On the Horizon?

MacGuineas expressed concern about a potential return to detrimental practices, “But as we enter 2024, there is a huge risk we will return to making things worse,” she noted.

Where The Risks Lie

The risk lies in the possibility of introducing “new tax cuts, spending increases, and/or ignoring the caps agreed to in the FRA,” according to MacGuineas.

Medicare and Social Security

Without changes to current funding practices and fiscal policies, major government programs like Medicare and Social Security face a significant funding shortfall by 2033.

Peterson also spoke of the difficulty of finding solutions while the country faces inflation and higher interest rates.

Politics and Debt Reduction

Calls for debt reduction from both Democrats and Republicans in the past have often resulted in a political chess match rather than concrete action. A recent example is the near stalemate in passing appropriations bills.

Blaming the GOP

White House spokesman Michael Kikukawa blamed the GOP for the rising debt. He attributed the steady “accrual” over the years to “trickle-down debt, driven overwhelmingly by repeated Republican giveaways skewed to big corporations and the wealthy.”

Peterson’s Call for Unity

Despite the blame game, Peterson also introduced a note of optimism, suggesting that unity can be found through a “bipartisan fiscal commission.”

A New Method

According to Peterson, a comprehensive process, supported by lawmakers from both sides of the aisle, can facilitate a much-needed examination of the entire budget.

Public Support for Change

Peterson pointed out that “nine-in-ten voters, across party lines, support a bipartisan fiscal commission.”

Time For a Better Future

These calls for change show that the nation cannot continue borrowing its way to a positive economic future, and both the government and the GOP must work together to find a solution.

More From Frugal to Free…

U.S. Budget Breakthrough: A Huge Step Forward Amidst Looming Shutdown Threat

Will Easing Inflation in America Continue?

The post Catastrophic: U.S. $34 Trillion Debt Set To Rise By Trillions Over Coming Decades first appeared on From Frugal to Free.

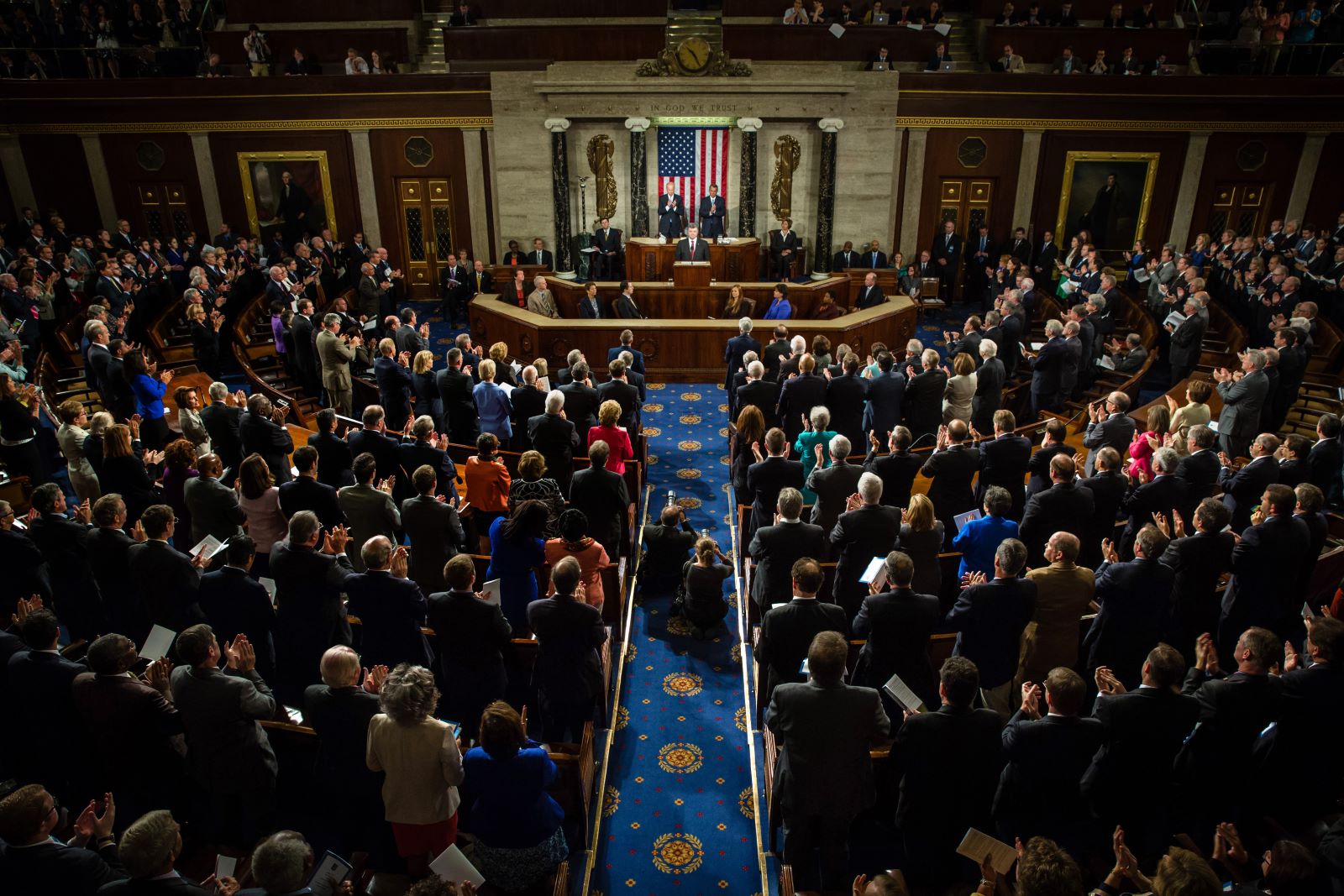

Featured Image Credit: Shutterstock / zimmytws. The people shown in the images are for illustrative purposes only, not the actual people featured in the story.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.