If you’re a millennial (born between 1981 and 1996) then right now you have a number of concerns related to your personal finances.

According to the Pew Research Center, your household income was on average about $69,000 (2017). Congratulations, that is better than any generation starting out in the past 50 years!

In terms of debts, you have may have student loans, a car payment, rent or mortgage to pay for your apartment or house, and perhaps some consumer debt such as a credit card or line of credit.

But through some act of providence, belt-tightening, careful money management, or a combination thereof, you now find yourself with some extra cash you would like to invest.

And with this investment portfolio you would like a steady stream of income, as opposed to a long-term growth strategy for a retirement account such as an IRA or a 401(k).

Okay, so you want to learn about income investing for millennials. But, what do income portfolios look like?

Historically, the three main asset classes in income investing portfolios have been equities (stocks), fixed income (bonds) and cash equivalent or money market instruments. More specifically portfolios that are designed to generate income for their owners often consist of investment-grade, fixed income obligations of large, profitable corporations, real estate investment trusts, or shares of blue-chip companies with long histories of continuous dividend payments.

Currently, most investment professionals include real estate, commodities, futures, other financial derivatives and even cryptocurrencies to the asset class mix. Lets look at each of the main asset classes in turn:

Dividend-paying Stocks:

If you’re looking for stocks for an income portfolio, here are criteria to consider:

- A strong record in increasing dividends. If company management is focused on shareholder needs, they will return excess cash the company generates to its stockholders.

- A dividend yield of between 2 percent and 6 percent. That means if a company has a $15 stock price, it pays annual cash dividends of between $0.30 and $.90 per share. Between 2 and 6 percent is usually a sustainable dividend payment rate over the long term.

- A dividend payment of not more than 50% of the companies profits. If a business disburses too much of its profit, it can hurt the firm’s long term prospects.

- The company should have no losses for the past three years, at a minimum. Essentially income investing is about holding onto your principle, not about getting explosive growth in the value of your shares.

- A healthy return on equity, or ROE, with little to no corporate debt. If a company can earn high returns on equity without a lot of debt, it usually has an above-average business. This means the company is better able to survive recessions and has stronger capacity to pay its bills.

Bonds:

Unlike stocks, with a bond you are lending money to the company or government that issues it. When you buy a bond, you are loaning that company or government money and they pay you interest for the privilege. With a stock, you own a piece of a business. The potential profit from bonds are much more limited but bonds are generally considered safer due to legal protections for bondholders.

Utilities, municipals, and treasury bills are just a few of the types of bonds available in the bond market

The safest bonds would be treasury bills, of course, with the backing of the U.S. government.

From a tax perspective, bonds may have a tax advantage over stocks. We will cover that more in the section on taxes.

Characteristics of Bonds to Consider or Avoid

Bonds are an important component of income investing because they generally fluctuate much less than stocks.

While safer, bonds do have some risk. In fact, bonds have a set of unique risks for income investors. Here is what you should look for when selecting bonds for an income investing portfolio:

- Bonds such as municipal bonds or bond funds that offer tax advantages. Individual bonds aside, a better choice may be bond funds. Bond funds generally allow you to spread your risk around and may better able to maximize your capital.

- Bonds with long duration. A major risk in investing in bonds for income is bond duration. You typically shouldn’t buy bonds that mature in more than 5-8 years. This is because the bonds can loose a lot of value if interest rates change substantially.

- Consider avoiding foreign bonds. This is because the value of foreign bonds can fluctuate based on changes in the value of foreign currencies relative to the US dollar.

- Use your age as a rule of thumb. If you are trying to figure out the percentage of your portfolio to invest in bonds, you can follow Burton Malkiel’s rule. The percentage you should have in bonds is your age. If you’re 35, 35 percent of your portfolio should be in bonds. If you’re 70, 70 percent.

Money market accounts and other cash equivalents:

When you open up a money market account at a bank, the bank pays you a fixed or variable rate of interest on that account (for the privilege of using your money for investment purposes).

That interest is income. Interest-paying checking and savings accounts also fall in this category. Interest on money market accounts tends to be much lower than the interest paid on bonds. This is because cash is basically a risk free asset. An FDIC-insured account is the safest place to invest your money (other than a safe deposit box).

Real Estate

At its most basic level, income real estate investing means buying a piece of property then renting it out to someone you trust. The money you make after expenses (maintenance, mortgage, taxes, vacancy rate and other expenses) is income.

Rental properties come with a slew of benefits beyond the income, from tax advantages to predictable returns to leveraging other people’s money to grow own portfolio of assets. You can cover 80% or more of the acquisition costs with an investment property loan, to build ongoing income from an asset largely paid for by someone else. Your tenants then pay down that loan for you over time, even as your asset appreciates in value and keeps earning you money.

Best of all, your rents rise over time, even as the monthly payment on your investment property loan stays the same. That means your spread – your cash flow – rises far faster than the rent itself. If you raise the rent by 3% from $1,000 to $1,030, and your cash flow after the property loan and other expenses was $100, it rises to $130: a 30% rise in profits on a 3% rise in income.

If direct real estate investing doesn’t appeal to you, consider REITs. Real Estate Investment Trusts (REITs) basically buy income-producing investment properties like an individual investor, but on a larger scale and funded by you instead of a property loan. They are similar to stocks except that the company issuing shares holds a group of real estate investments, instead of some other business. REITs are nice because they provide a steady stream of income and you would avoid some of the hassles of traditional real estate investing.

The portion of real estate in your portfolio would depend on your tolerance for risk. But the law governing REITs requires that 90 percent of net income be returned to investors. That means that income may be higher on REITs than stocks, dividends or interest on bonds.

Other Potential Income Investments

Not for beginners: Commodities (silver, chocolate, pork bellies), futures (bets on future investments), other financial derivatives and even cryptocurrencies (Bitcoin) can be added to the asset class mix. But these are better left for experienced investors. It is always wise to talk to your financial adviser before venturing into riskier investments.

Types of investors who would opt for an income strategy portfolio

Income investing typically isn’t for people in the wealth accumulation phase of life. Those who prefer the income strategy approach usually fall into one of two camps.

1) Retirees. The first is someone who is retired and wants to live off his or her money to the maximum degree possible without drawing down too much principal. By opting for slower-growing, higher-payout stocks, bonds, real estate, and other assets, he or she can achieve this.

2) Windfall recipients. The second is a person who receives a lot of money in some sort of windfall – selling a business, winning a lottery, inheriting from a relative, or the like.

If the money could make a big difference in their standard of living but they want to make sure it is there for the rest of their lives, they might opt for the income strategy to serve as a sort of second or third take-home paycheck.

Picture a teacher earning $40,000 married to an office manager earning $45,000. Together, they make $95,000 before taxes.

Now imagine they somehow come into $1,000,000. By going with an income strategy that produces, say, 4 percent annual payouts, they can take a $40,000 check from their portfolio year, increasing their household income to $135,000, or more than 42 percent.

That is going to make a huge difference to their standard of living and they figure they’ll enjoy it more than having even more capital when they’re older.

The $1,000,000 serves as a sort of family endowment, much like a college or university; money that is never spent but devoted solely to producing spendable funds for other purposes.

Tax Refresher on Investment Income

In any discussion of investment income, taxes need to be a consideration. Dividend and capital gains tax can cut into your return on investments.

Interest: Interest income is the easiest to deal with since almost all interest is taxed as ordinary income. Interest you earn from checking, savings, and money market accounts, CDs, bonds, and bond funds are all taxed at your marginal tax rate. There are exceptions. Municipal bonds are exempt from Federal tax and U.S. Treasuries are exempt from state tax.

Dividends: Every dividend is ordinary unless it meets the three IRS requirements that qualify it for the lower tax rate. The most important is the holding period, which says you must own the shares for at least 61 days, including the ex-dividend date. Long-term investors shouldn’t have any problems with this.

Not all dividends are real dividends. The term gets loosely used to cover anything from capital gains distributions from mutual funds, interest on a savings account, dividends from a REIT, and more, that the IRS considers non-qualified dividends. Know the tax consequences of an investment before you get into it so you can invest your money efficiently.

Contribute to tax-efficient accounts: According to Merrill (“Tax-smart investment strategies you should consider”), be sure to take advantage of tax-efficient retirement accounts [IRA, 401(k), for examples] for which you are eligible to reduce current and or future taxes.

On employer-sponsored retirement plans, your company may offer a match up to 5 percent. Be sure to take advantage of this windfall.

Choose tax-efficient investments: Some types of investments can carry tax benefits as well. Tax-managed mutual funds are a good example of this. These are funds whose managers work deliberately and actively for tax efficiency, as well as index funds and exchange-traded funds that passively track long-term investments in a target index.

It’s important to check with your tax advisor to make sure you understand the tax features of these investments.

What is sustainable, responsible and impact (SRI) investing?

Okay, now that the tax stuff is out of the way, what about the broader impact of investing for society and the environment? For this you’ll want to know about SRI.

Sustainable, responsible and impacting investing (SRI) is an investment discipline that considers environmental, social and corporate governance (ESG) criteria to generate long-term competitive financial returns and positive societal impact.

According to the US Sustainable Investment Forum’s 2018 Report on US Sustainable, Responsible and Impact Investing Trends, as of 2017, more than one out of every four dollars ($12.4 trillion) under professional management in the United States was invested according to SRI strategies.

Motivations:

There are several motivations for sustainable, responsible and impact investing, including personal values and goals, institutional mission, and the demands of clients, constituents or plan participants.

Sustainable investors aim for strong financial performance, but also believe that these investments should be used to contribute to advancements in social, environmental and governance practices.

They may seek out investments—such as community development loan funds or clean tech stock portfolios—that are likely to provide important societal or environmental benefits.

How do I SRI?

The US Sustainable Investment Forum has published five handbooks under its “How Do I SRI” series. These are available online. (Three of the handbooks are described below.) The first one is a primer for individual investors to get started in sustainable and impact investing. Getting Started in Sustainable and Impact Investing: A Guide for Retail Investors is a concise resource to help retail, non-accredited investors start investing for impact.

It covers investment options, including mutual funds and ETFs, direct ownership of stocks, and community-oriented cash and fixed income products. It also provides information on how to get professional investment help from financial advisors or through robo-advisors that offer SRI options. Available here.

Investing to Advance Women: A Guide for Individual and Institutional Investors highlights investment vehicles and strategies, including shareholder engagement, in which investors can participate to increase economic opportunities for women in the United States and around the world. Available here.

The guide reviews options across a range of asset classes and vehicles, including stocks, mutual funds, fixed income and cash instruments.

Investing to Curb Climate Change: A Guide for the Individual Investor seeks to meet the increased interest of a wide range of investors in using their investment dollars to address the risks of climate change and to help generate solutions. Here.

The guide highlights strategies that retail investors can use not only to address climate change within their own holdings, but also to encourage institutions in their communities to adopt more climate-sensitive investment policies.

The guide also suggests several public policy initiatives investors can support to facilitate investments in clean energy and energy efficiency.

How Do I Get Started Income Investing?

So now that you have the basics, how do you get started in income investing for millennials? Getting started isn’t hard, but it takes time and effort.

First, you’ll need a brokerage account. A discount full service brokerage like Charles Schwab or Fidelity Investments is probably your best bet. Their fee structure is discounted, and they have access to a full range of financial products. A lot of the newer brokerage start ups like Stockpile have limited access to some financial products, such as bonds or specialty bond funds.

Second, you’ll need to open an account and deposit some money into it. You’ll probably need between $500 and $3,000 to get started. This is because some funds have a $3,000 minimum to purchase shares and because most brokers will charge you a commission of between $1 and $50 to make transactions happen. Bonds are typically denominated in units of $1,000 and you’ll at least want to get a few of these.

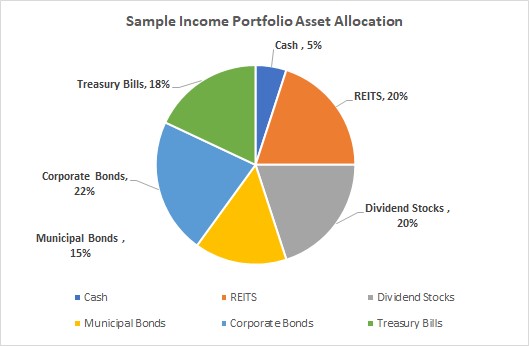

Third, you’ll probably need a picture of what kind of asset allocation you want. Basically you need a picture of where you’re going. Asset allocation is basically how you spread your money around across the various investment choices you have. For example a 35 year old could go with 33% stocks, 35% bonds, 32% real estate (33/35/32). The literature on asset allocation is broad, but a good rule of thumb is: diversify. This is allows you to better control risks. Here is a graphic of what your potential asset allocation might look like.

Fourth, income investing takes time and effort.

Start buying. Do it consistently for a long time. Income investing takes a while – sometimes decades. Let’s say that you wanted to replace your salary with income from your investments and let’s assume you did earn $69,000 per year. Assuming your portfolio paid you a sustainable 3.5% you’d need about $1,971,429 in investment capital. That’s doable, but for most people it takes time to accumulate.

There are no shortcut in income investing. You’ll have to work at it. Building up passive income requires learning about investing as well as developing a basic knowledge of various asset classes. You’ll also need to keep an eye on the portfolio and manage it. All this requires effort.

Lastly for more of our great articles read these:

How Much Interest Does A Million Dollars Earn?

Can You Live Off The Interest On A Million Dollars

Don’t Use Your 401K To Pay Off Debt

Yes, You Can Make $1,000 A Day

If you liked this article please don’t hesitate to leave a comment below or share it on social media.

Author: Don Snedecor.

Don is the founder of the Southwest Portland Post, a local newpaper in Portland, Oregon. Don has comprehensive experience in newspaper operations, marketing, and related best practices. His passion is producing impactful articles for digital/print publications of newspapers, magazines, and blogs that drives readership and social media. Don holds a Bachelor of Arts from Portland State University with a focus on journalism. Don is also a founding member of the Woodstock Farmers Market, a founding member of the Portland Community Newspaper Association.