As we age, health insurance becomes more crucial than ever. Unfortunately, many of us fall into traps that can cost us dearly. Avoiding these 18 common health insurance mistakes helps you safeguard your health and finances as you get older.

#1. Ignoring Long-Term Care Insurance

Many people overlook long-term care insurance, thinking they won’t need it. But as we age, the likelihood of requiring such care increases.

Investing in long-term care insurance potentially saves you from hefty future expenses and gives you peace of mind.

#2. Underestimating the Need for Supplemental Plans

Relying solely on basic health insurance can be risky. Supplemental plans cover gaps that standard policies don’t, such as extended hospital stays or specialized treatments.

Assess your health needs and consider getting additional coverage.

#3. Missing Open Enrollment Periods

Skipping the open enrollment period can leave you stuck with an unsuitable plan for a whole year. Mark your calendar and review your plan options during this crucial time.

Staying proactive ensures you have the best possible coverage.

#4. Overlooking Employer Benefits After Retirement

If you’re retiring, don’t assume your employer-sponsored health insurance ends there. Some companies offer extended benefits or retiree health plans. Check with your HR department to understand your options.

#5. Choosing Plans Based Solely on Premiums

While low premiums are attractive, they often mean higher out-of-pocket costs. Look beyond the premium and evaluate deductibles, copays, and coverage limits. A plan that seems cheaper can cost more in the long run.

#6. Not Reviewing Plan Networks

Staying within your insurance plan’s network is crucial to avoid unexpected bills. Always check if your preferred doctors and hospitals are covered under your plan’s network before enrolling.

#7. Forgetting to Update Life Changes

Significant life changes, like marriage or moving house, can impact your health insurance needs.

Update your insurer about these changes to ensure your coverage remains relevant and adequate.

#8. Ignoring Preventive Care Benefits

Many health insurance policies offer free preventive services like screenings and vaccinations. Skipping these benefits jeopardizes your health and leads to higher costs later due to untreated conditions.

#9. Disregarding Out-of-Pocket Maximums

Out-of-pocket maximums can save you from financial strain during a health crisis. Understand these limits in your plan to better prepare for unexpected health expenses.

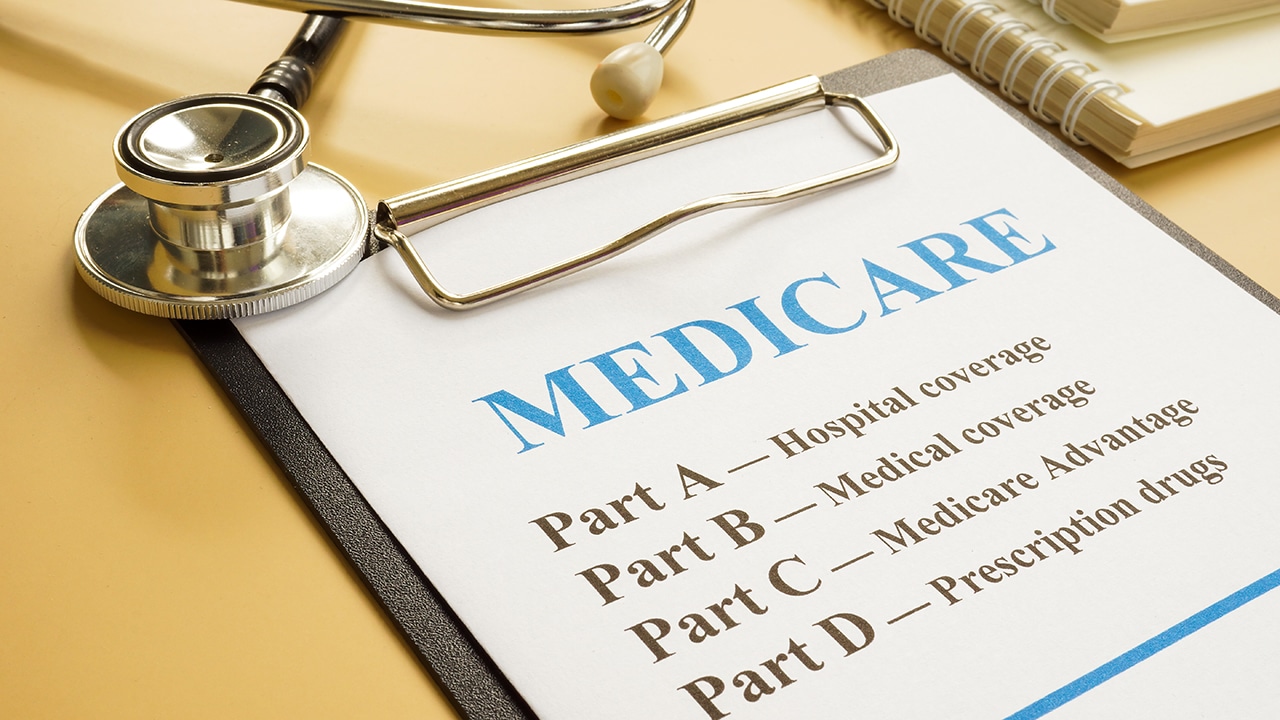

#10. Not Understanding Medicare

As you approach 65, understanding Medicare becomes crucial. Missing enrollment deadlines or misunderstanding coverage can lead to penalties and gaps in coverage.

Take time to learn about Medicare’s different parts and options.

#11. Overlooking Spousal Plan Options

If your spouse is still working, compare their employer’s health plan with yours. Sometimes, joining your spouse’s plan can offer better benefits or lower costs.

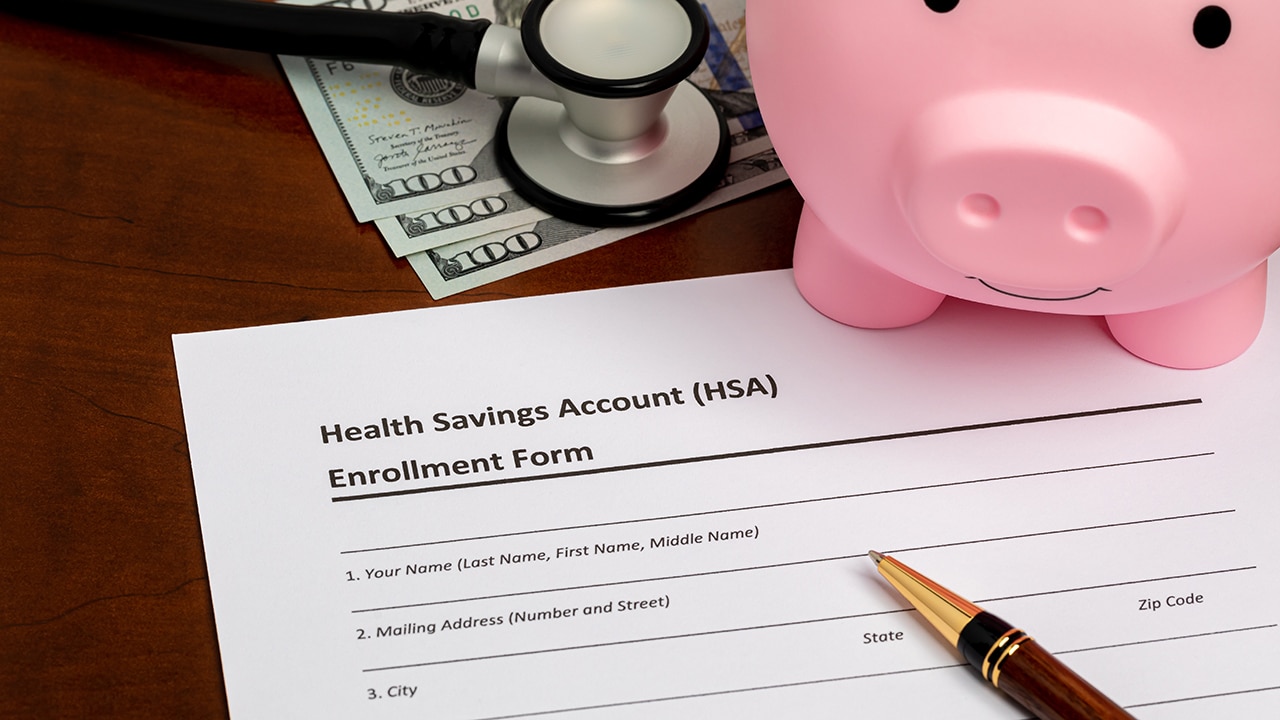

#12. Not Utilizing Health Savings Accounts (HSAs)

HSAs offer triple tax advantages, and you can use them to pay for a wide range of medical expenses. If eligible, not using an HSA is a missed opportunity to save on healthcare costs.

#13. Choosing the Wrong Prescription Drug Plan

Prescription needs can change as we age. Annually review your prescription drug plan to ensure it still covers your medications at a reasonable cost.

#14. Ignoring Assistance Programs

Numerous assistance programs for older adults can help reduce healthcare costs. Research programs like Medicaid, state-sponsored programs, or pharmaceutical assistance programs.

#15. Not Seeking Professional Advice

Health insurance can be complex, and mistakes can be costly. Consulting with a health insurance advisor can provide clarity and help you make informed decisions.

#16. Failing to Appeal Denied Claims

If your claim is denied, don’t just accept it. Understand the reason for denial and file an appeal if warranted. Many denied claims are overturned upon appeal.

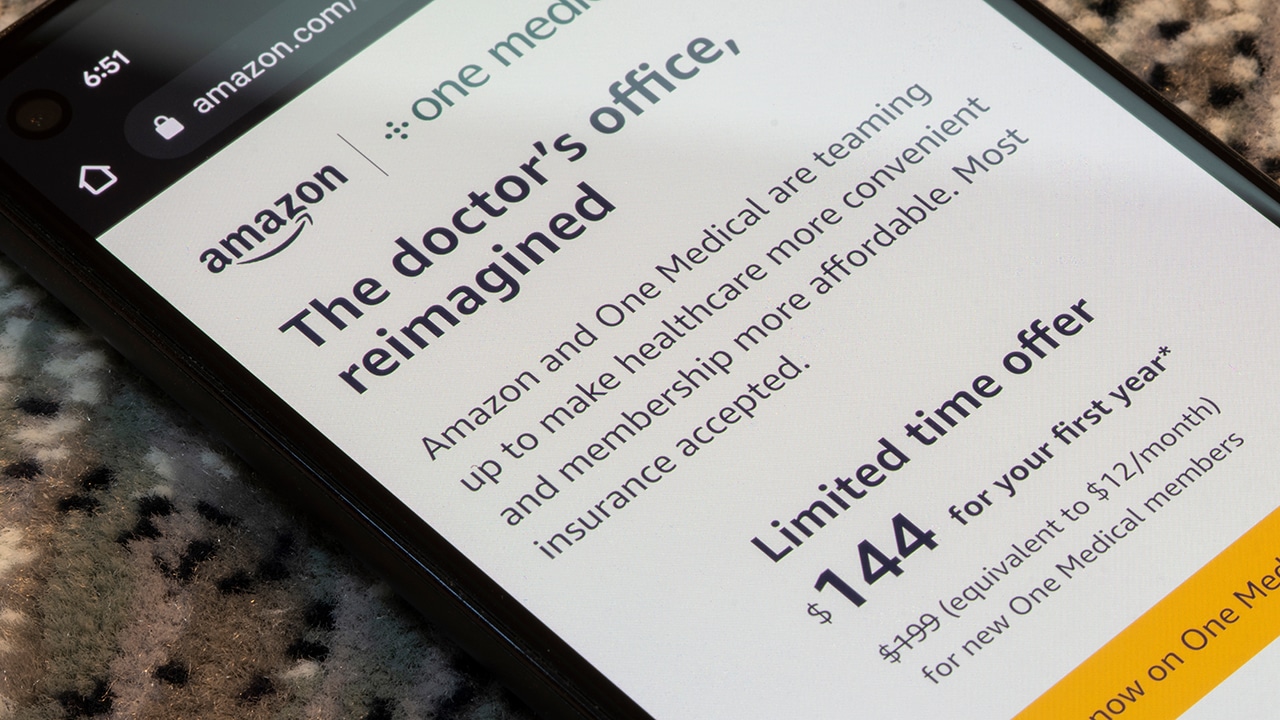

#17. Overlooking Telehealth Options

Telehealth services can be a cost-effective way to receive care, especially for routine follow-ups or minor issues. Check if your plan covers telehealth and take advantage of it when appropriate.

#18. Not Planning for Travel

If you travel frequently, ensure your health insurance covers you adequately in other states or countries. Travel health insurance can be a wise investment for peace of mind while you’re away from home.

More From Frugal to Free…

U.S. Budget Breakthrough: A Huge Step Forward Amidst Looming Shutdown Threat

Will Easing Inflation in America Continue?

The post 18 Overlooked Health Insurance Mistakes to Avoid As You Age first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / Perfect Wave.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.