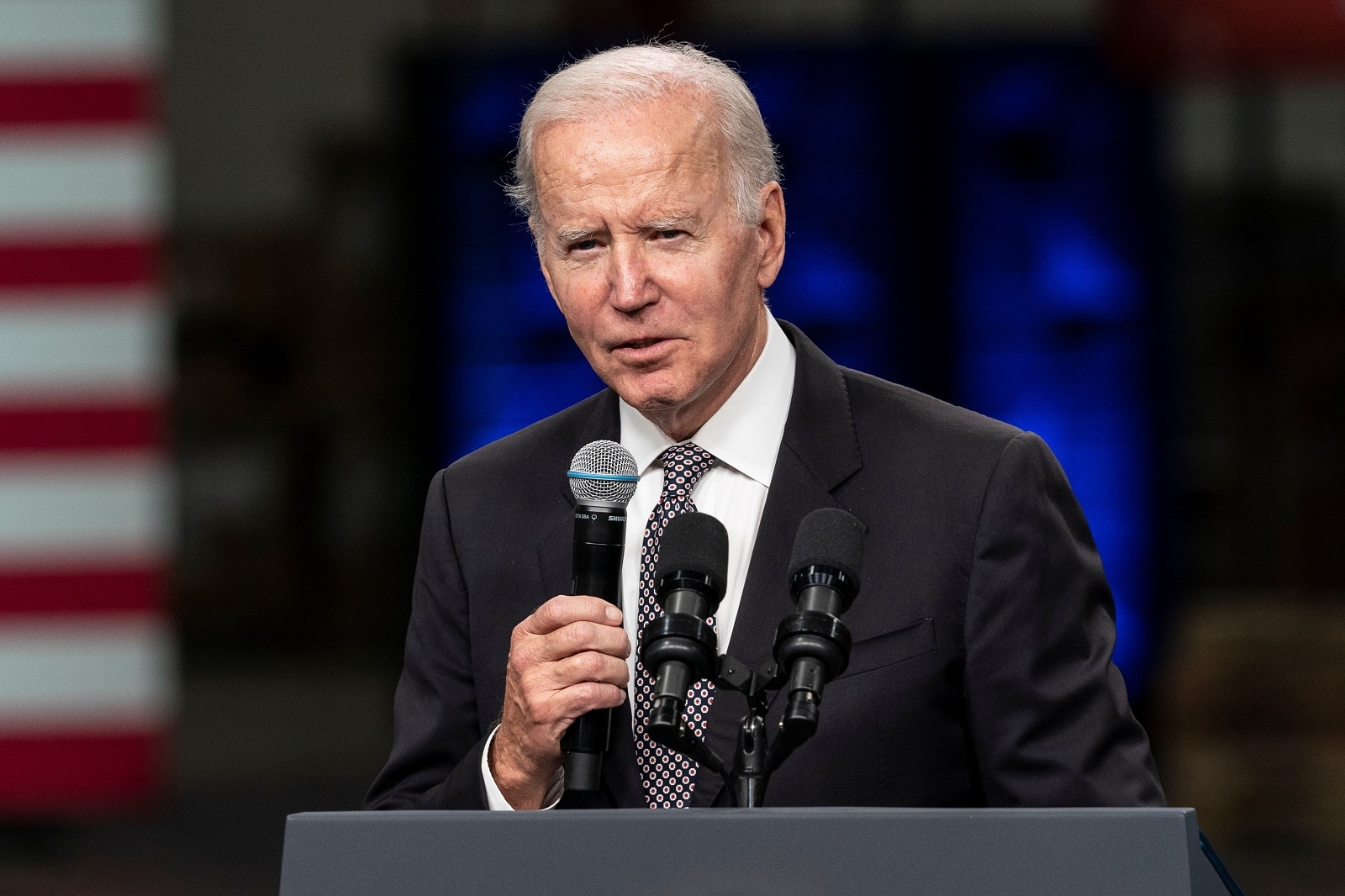

President Biden’s latest proposal is set to overhaul how financial advisors manage client funds, with the potential for a significant impact on retirement savings.

The Core Idea

President Biden has proposed a new rule aimed at ensuring financial advisors work solely in their client’s best interests.

Closing Loopholes

The rule is designed to prevent advisors from recommending investments that earn them higher commissions but aren’t in the best interest of the clients.

Hidden Costs

These hidden fees can substantially erode savings over time and are often a result of advisors choosing investments that are more beneficial to them.

The Impact on Savings

According to the White House, implementing this rule could enhance retirement savings by as much as 20% over a lifetime.

The Downside

Critics argue that the rule will increase operating costs for financial advisors, potentially leading to fewer choices for clients, especially those with smaller savings.

Loss of Access

Industry expert Wayne Chopus warns that this rule could limit the public’s access to necessary financial advice.

What’s a Fiduciary?

Under the proposed rule, advisors would be obligated to prioritize client needs, whether giving advice on stocks, bonds, or insurance products.

One-Time Advice

The rule also targets key moments, such as when individuals transition funds from an employer-sponsored retirement plan to a personal account.

Employer Plans

The proposal would provide guidelines for companies on the kinds of investment options they should offer employees, an important consideration since many Americans save for retirement through their workplace.

A Look Back

This isn’t the first time such a rule has been proposed; a similar rule in 2016 faced significant opposition from the financial industry.

What Went Wrong Before?

The 2016 proposal was ultimately struck down in court. Detractors said it was too broad and restricted access for many retirement account holders.

What’s Different Now?

The current rule is more targeted and chiefly applies to advisors who charge a fee for retirement-related advice.

Legal Outlook

The rule is now in a public comment stage, followed by a hearing. Its ultimate fate will likely be decided afterward.

Opposition Gears Up

The financial industry has signaled its intent to oppose this rule as it did with the 2016 version, which raises questions about its long-term viability.

Bottom Line Impact

Opponents suggest that rather than helping, the rule may actually harm individuals who are already finding it challenging to save for retirement.

How to Prepare

While the rule’s future is uncertain, it’s advisable for the public to stay informed. Knowledge of these developments can aid in making more sound financial decisions.

Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

The latest Biden administration rule on 401(k) plans is reshaping how employers manage retirement plans. It’s a complex scenario requiring a fresh understanding of fiduciary duties and provider relationships. This rule aims to protect employees but also imposes new responsibilities on employers. Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Elon Musk is calling for prosecutions after the text for a new senate bill on immigration was released. Musk accused the new bill of “enabling illegals to vote.” Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

With increasing numbers of migrants arriving in Colorado, public officials have rejected any notion of the state becoming a sanctuary for migrants and asylum seekers. Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Disney is set to appeal its refusal for a lawsuit against Ron DeSantis, who stripped the company of its rights for disagreeing with the Governor’s views on the teaching of sexual orientation in classrooms. Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

An unprecedented surge in health plan enrollments has reignited former President Donald Trump’s commitment to dismantling the program should he secure the GOP nomination once again. Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

The post Biden’s Vote Gambit: Retirement Savings Boost Aims for Older Voters first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / goodluz.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.