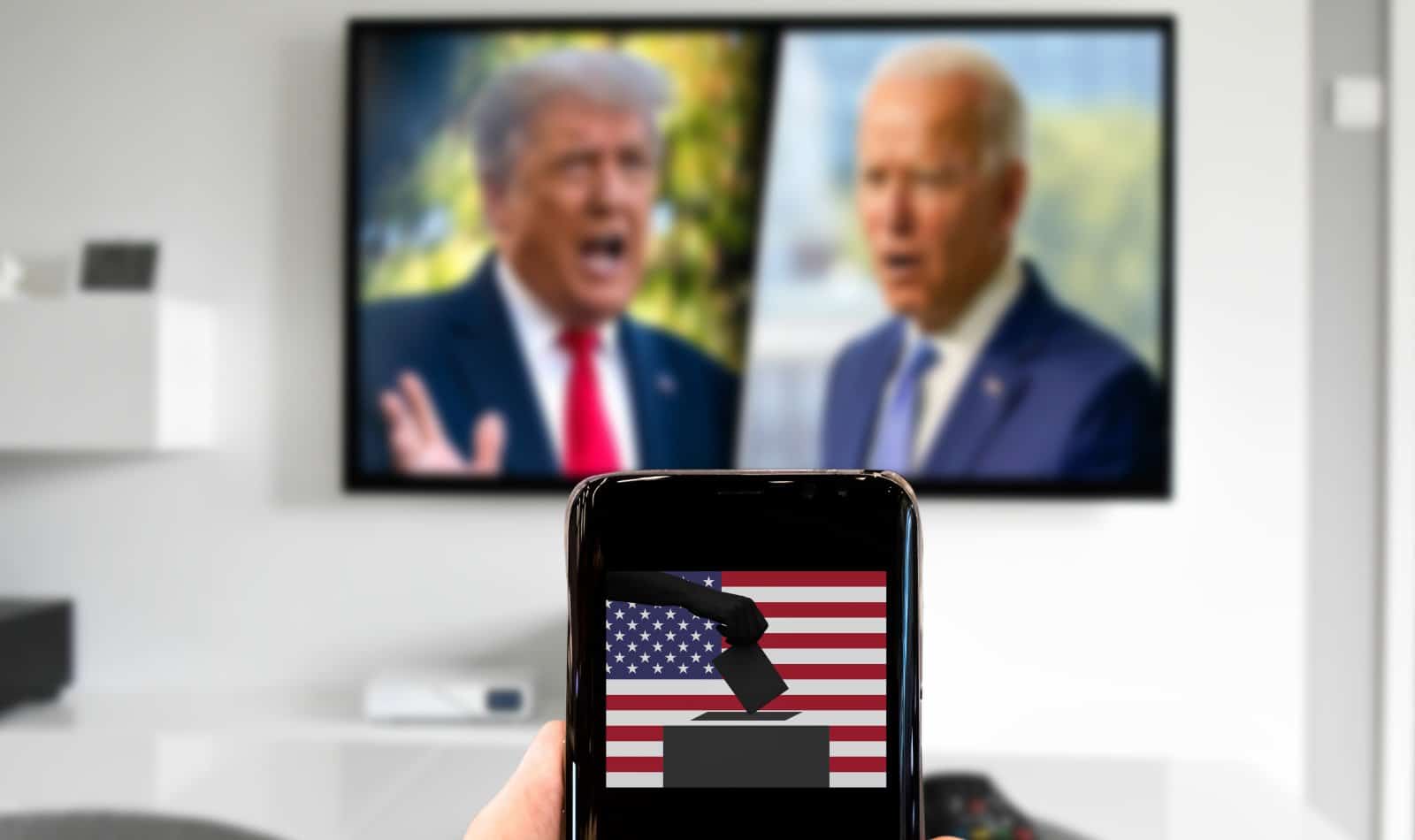

As the 2024 Presidential primaries progress, the potential impact on the stock market becomes a topic of significant interest. This analysis aims to shed light on historical trends and what investors might anticipate as November’s election approaches.

Presidential Primaries and Market Indifference

To date, the presidential election cycle has not had a direct influence on market trends. Despite the political buzz, stock markets have largely continued on their established trajectories, unaffected by the primary season’s developments.

Future Market Movements and Political Outcomes

But, investors are beginning to speculate on sectors that might benefit depending on whether Trump or Biden wins in the polls. As the election draws nearer, how different industries could fare under the governance of the leading political parties is coming into focus for many investors.

The Race for the White House

The battle for the presidency is heating up, and the political showdown is underway. And each party’s national policy could potentially have a direct impact on market dynamics.

Election Outcomes vs. Market Performance

However, a comprehensive study by U.S. Bank strategists reveals minimal long-term market impact directly attributable to election results.

Instead, economic and inflation trends hold more sway over market behavior than the electoral cycle.

Party Platforms and Investor Strategy

Investors are keenly awaiting party platforms, which are expected to provide clearer insights into future market directions.

The platforms will likely outline the policies and sectors poised for growth, influencing investment strategies.

Congressional Elections’ Role

Beyond the presidency, Congressional elections are set to play a crucial role in shaping policy and, by extension, market trends.

The balance of power in Congress could pivot, affecting sectors differently based on legislative priorities.

Polls Indicate a Tight Race

Current polls suggest a closely contested race between Biden and Trump, especially in key battleground states.

Historical Analysis of Elections and Market Trends

U.S. Bank’s review of market data since 1948 suggests that the political composition of Congress and the presidency has a less significant impact on markets than commonly believed.

The analysis challenges the notion that single-party control leads to market disruptions.

Divided Government and Market Performance

Interestingly, scenarios of divided government have historically correlated with market performance variations.

Some configurations have resulted in above-average returns, illustrating the complex relationship between political control and market dynamics.

Economic and Inflation Trends Prevail

Economic growth and inflation trends are more indicative of market performance than election outcomes. Investors might find greater value in monitoring these indicators over election-focused speculation.

Midterm Elections and Market Behavior

Analysis of midterm election years reveals that the S&P 500 typically fares better in the year following midterms.

This trend underscores the limited direct impact of political control on market performance.

Sector-Specific Election Impacts

While overall market trends may not heavily depend on elections, specific sectors can experience significant shifts based on policy changes proposed by incoming administrations or Congress.

Key Policy Watch Areas for Investors

Investors should monitor developments in tax policies, spending priorities, healthcare, regulation, immigration, and geopolitical issues throughout the election cycle.

These areas are likely to influence market sectors differently based on the election’s outcome.

Election Delays and Market Uncertainty

Historical election disputes have led to temporary market volatility. Uncertainty during such periods can affect riskier asset classes until clearer outcomes are established.

Looking Ahead

Despite the Biden-Trump rematch on the horizon and Congressional control up for grabs, investors are advised to focus on long-term economic indicators and sectoral shifts.

Immediate electoral events are likely to have less impact on the markets than broader economic trends in the long term.

Investor Focus Beyond Elections

Ultimately, staying informed about economic growth, interest rates, inflation, and corporate earnings is crucial for making sound investment decisions.

These factors are likely to have a more substantial influence on portfolio performance than the upcoming presidential election.

Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

The latest Biden administration rule on 401(k) plans is reshaping how employers manage retirement plans. It’s a complex scenario requiring a fresh understanding of fiduciary duties and provider relationships. This rule aims to protect employees but also imposes new responsibilities on employers. Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Elon Musk is calling for prosecutions after the text for a new senate bill on immigration was released. Musk accused the new bill of “enabling illegals to vote.” Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

With increasing numbers of migrants arriving in Colorado, public officials have rejected any notion of the state becoming a sanctuary for migrants and asylum seekers. Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Disney is set to appeal its refusal for a lawsuit against Ron DeSantis, who stripped the company of its rights for disagreeing with the Governor’s views on the teaching of sexual orientation in classrooms. Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

An unprecedented surge in health plan enrollments has reignited former President Donald Trump’s commitment to dismantling the program should he secure the GOP nomination once again. Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

The post The Trump vs. Biden Election Impact: Safeguarding Your Portfolio Strategies first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / Below the Sky.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.