A report by Americans for Tax Fairness has revealed alarming trends in untaxed wealth among America’s elite, sparking questions about financial equity and coinciding with a pivotal Supreme Court case. Here’s the full story.

Massive Accumulation of Untaxed Capital Gains

In a surprise revelation, a recent report from Americans for Tax Fairness has shed light on the massive accumulation of untaxed capital gains by America’s wealthiest families in 2022 – a massive $8.5 trillion, to be precise.

Unrealized Gains in The Hands of The Ultra-Wealthy

The nonprofit organization, drawing from Federal Reserve data, uncovered a notable trend where approximately one-sixth of the nation’s unrealized gains, constituting 18 percent of the total, is concentrated in the hands of a mere 64,000 ultra-wealthy households, accounting for less than 0.05 percent of the population.

Supreme Court’s Pivotal Role in Wealth Taxation

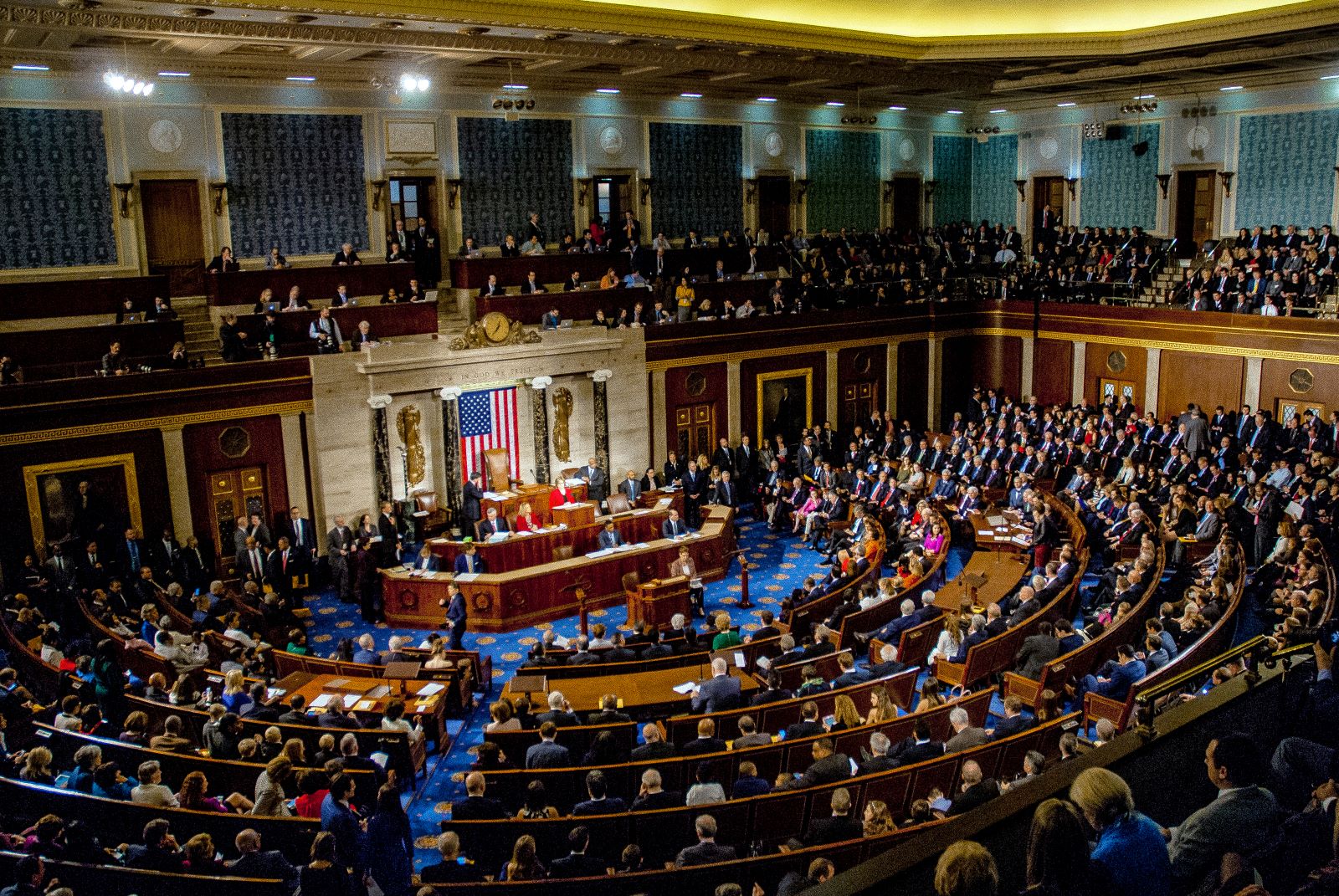

This eye-opening data comes at a critical juncture as the Supreme Court prepares to weigh in on a pivotal case that could potentially preemptively block any future attempts to tax the immense wealth held by billionaires. The case, Moore v. United States, currently under the court’s scrutiny, has broader implications for major tax reforms targeted at the ultra-wealthy.

“Quiet” Income and Unrealized Gains

The report delves into the realm of “quiet” income generated by “centi-millionaires” (individuals holding a minimum of $100 million in wealth) and billionaires through unrealized capital gains.

These gains, arising from the appreciation of assets like stocks, real estate, bonds, and other investments, remain untaxed as long as the assets are not sold or “realized.”

Taking Advantage of Loopholes

This loophole enables the wealthiest families to leverage the increased on-paper value of these assets to obtain favorable loans with lower interest rates, avoiding using taxable income to finance their lifestyles.

Wealth Disparity in the United States Laid Bare

The wealth distribution in the United States is starkly outlined in the report, revealing that nearly three-quarters (73 percent) of the nation’s $139 trillion in wealth is held by the top 10 percent of households.

The top 1 percent alone holds 35 percent, while the billionaire and centi-millionaire class possesses an astonishing 11 percent, equivalent to $15.2 trillion.

$8.5 Trillion in Untaxed Wealth

The report emphasizes that “the wealthiest 1 percent of households hold 44 percent of national unrealized gains ($21.2 trillion), with billionaires and centi-millionaires alone controlling 18 percent ($8.5 trillion).”

Calls for Increased Financial Accountability Gain Momentum

The report underscores the pressing issue of growing wealth disparity in the country and a system that enables the wealthiest to take advantage of loopholes, minimizing their tax contributions.

Calls for increased financial accountability for the ultra-wealthy have gained momentum, but proposals for significant tax reforms may face an uphill battle.

Foreign Income Earnings

This term, the Supreme Court’s decision in Moore v. United States could have far-reaching consequences.

The case, challenging a “mandatory repatriation tax” under former President Donald Trump’s 2017 tax bill, questions the taxation of income generated by foreign earnings for Americans with business holdings abroad.

The Moores, the plaintiff couple, argue against the tax, claiming that since they did not distribute their earnings as dividends, they should be exempt.

Concerns About Potential Setbacks

While the case might seem obscure, its potential impact is substantial. It could significantly impact President Joe Biden and Sen. Ron Wyden’s efforts to tax unrealized gains made by billionaires, marking a significant setback for efforts to address wealth inequality.

A Massive Windfall to Multinational Corporations

Sen. Wyden expressed concerns about the case, stating, “If the Republicans on the Supreme Court take the petitioners’ side, they’d be handing a massive windfall to multinational corporations and could potentially lock in a right for billionaires to opt out of paying anything remotely close to a fair share in taxes.”

A Decades-Long Problem

The implications of this case are far-reaching, potentially unraveling decades of settled tax law and bipartisan agreements on Congressional authority.

Unity Among Ultra-Rich to Safeguard Wealth Raises Alarms

According to The Lever, an investigative news outlet, the Moores’ case has garnered support from billionaire think tanks and conservative dark money groups, including the Manhattan Institute.

This institute’s connections to figures involved in financial ethics scandals, such as Harlan Crow, raise questions about the potential influence of wealthy individuals on the court’s decisions.

Unity Among the Ultra-rich

The report concludes by highlighting the unity among the ultra-rich to safeguard their ability to hoard massive amounts of wealth while contributing minimally to the societies that sustain their business empires.

The report warns that without essential reforms to the taxation system, the growth of untaxed income at the top of the economy will persist, benefiting only a select few and detrimentally affecting everyone else.

The Future of Wealth Taxation

The Supreme Court’s decision in Moore v. United States holds the key to shaping the trajectory of wealth taxation in the United States, with significant implications for the nation’s economic future. The nation awaits the Supreme Court’s verdict.

Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

The latest Biden administration rule on 401(k) plans is reshaping how employers manage retirement plans. It’s a complex scenario requiring a fresh understanding of fiduciary duties and provider relationships. This rule aims to protect employees but also imposes new responsibilities on employers. Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Elon Musk is calling for prosecutions after the text for a new senate bill on immigration was released. Musk accused the new bill of “enabling illegals to vote.” Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

With increasing numbers of migrants arriving in Colorado, public officials have rejected any notion of the state becoming a sanctuary for migrants and asylum seekers. Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Disney is set to appeal its refusal for a lawsuit against Ron DeSantis, who stripped the company of its rights for disagreeing with the Governor’s views on the teaching of sexual orientation in classrooms. Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

An unprecedented surge in health plan enrollments has reignited former President Donald Trump’s commitment to dismantling the program should he secure the GOP nomination once again. Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

The post Untaxed Wealth at $8.5 Trillion: Supreme Court Reviews Taxation Laws first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / Jacob Lund.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.