Fresh from his retirement, famed banking analyst Richard X. Bove has delivered a prediction that could throw a spanner into the works of the U.S. economy. Here are his full remarks.

Bove’s Bold Prediction

“The dollar is finished as the world’s reserve currency,” announced Bove in an exclusive interview with the New York Times.

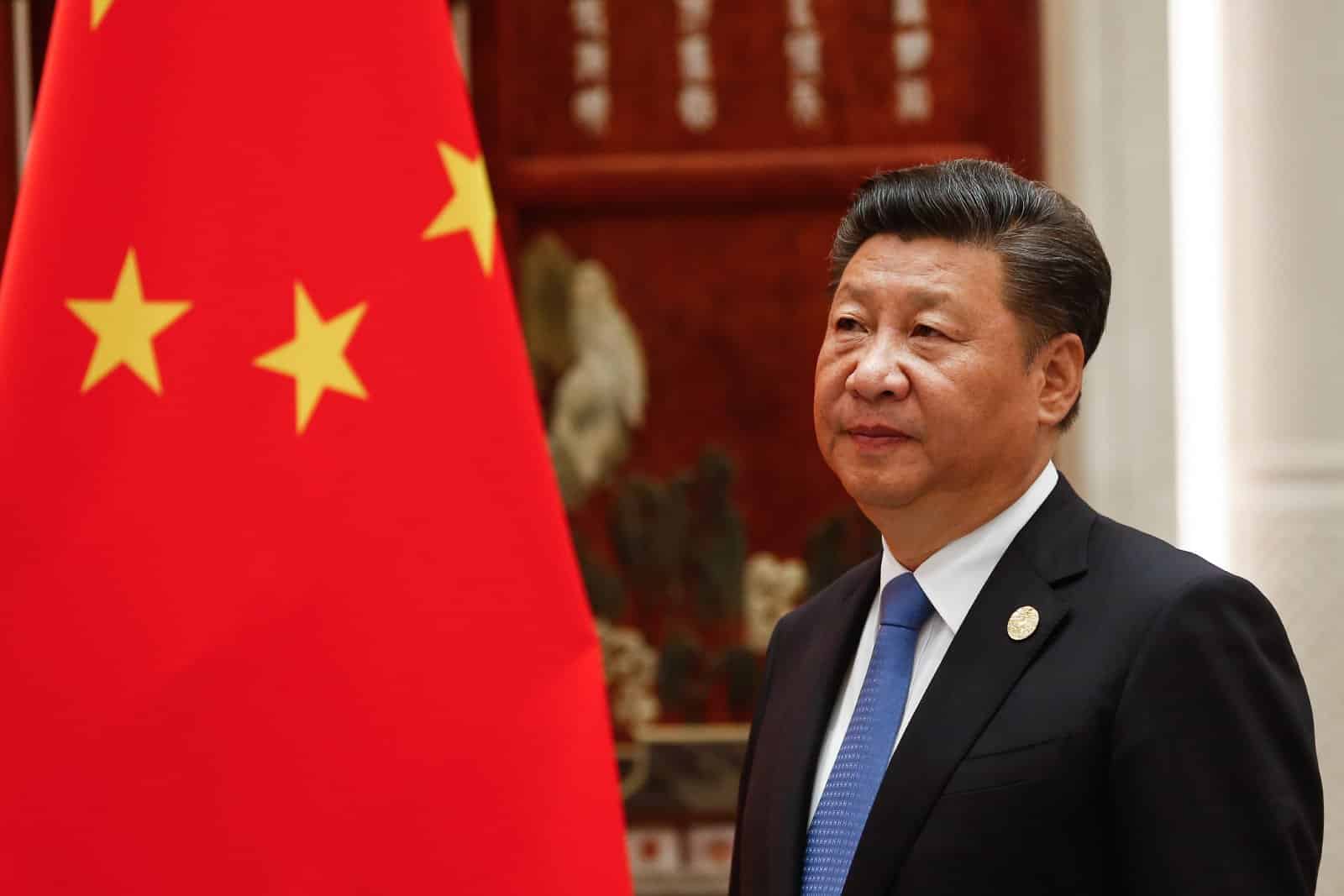

The Rise of China

Bove believes that China is on the brink of becoming the new United States (in regard to economic prowess).

Bove, who accurately predicted the 2008 housing crisis, now thinks that the U.S. dollar is on the verge of collapse, and when that happens, it will pave the way for China to assume the mantle of the world’s reserve currency.

Conflicting Perspectives

Bove’s recent proclamation, delivered in his signature dramatic flair, is in line with a broader perspective shared by economic analysts who forecast China’s economy will rise above the United States in the next 10 years.

Challenge to the Status Quo

The 83-year-old financial sage insists that his peers shy away from such bold declarations, accusing them of being financial monks tethered to a system they dare not critique.

Bove asserted, “You won’t hear this from other analysts. They are monks praying to money.”

Evergrande’s Impact

Bove’s prophecy comes at a unique time for America and China. The collapse of Evergrande, China’s second-largest property developer, has contributed to a massive recent upheaval in the Chinese property sector – which is responsible for almost 20% of the nation’s economy.

China’s Property Sector Crisis

China’s property sector has been strong for the past 25 years, but excessive borrowing by Evergrande developers, compounded over the years, has resulted in defaults and a housing crisis.

Just this week, Hong Kong courts ordered the liquidation of the company.

U.S. Economic Resilience

Meanwhile, the U.S. seems to be brushing off fears of a recession, as a recent survey indicated that 76% of economists believe the chance of a 2024 recession is 50% or less.

Bank of America’s Prediction

Couple that with the Bank of America predicting a soft landing, and it’s easy to see why so many experts have been confused by the timing of Bove’s prediction. Regardless, Bove stands behind his prediction.

Bove’s Background

Bove, based in Florida, boasts a storied career. He’s worked at 17 brokerage firms, finishing his journey at boutique brokerage Odeon Capital.

His track record includes both accurate and inaccurate predictions, but his 3-year early foresight on the 2008 housing crisis stands out and propelled him to fame.

A Controversial Figure

Bove is no stranger to controversy; he was dismissed from major firms such as Dean Witter Reynolds and Raymond James over his predictions.

Recognition and Criticism

While some on Wall Street dismiss Bove as an attention-seeking provocateur, others, including JPMorgan Chase’s CEO Jamie Dimon, recognize his strengths.

China’s Projected GDP

Bove’s latest forecast lines up with projections based on current growth rates, indicating that China’s GDP could surpass that of the U.S. within a decade.

Contrasting Economic Performance

However, contrary to Bove’s ominous prediction, recent economic indicators from the United States suggest quite the opposite.

U.S. Economic Growth

In the final quarter of last year, the U.S. economy exceeded expectations, with a 3.3 percent annual GDP growth, outpacing analysts’ consensus of 2 percent.

This marks the sixth consecutive quarter of the U.S. economy expanding at a pace of 2 percent or more.

Economic Momentum

American consumers provided the momentum behind the unexpected resilience of the U.S. economy.

Despite facing high interest rates and increased price levels, their willingness to spend helped the economy narrowly avoid a recession.

Good News Regarding Inflation

The Core PCE (Personal Consumption Expenditures) Price Index, an inflation measure used by the Federal Reserve that essentially tracks the average price for goods and services, rose by 3.2% annually, down 5.1% last year, and the lowest increase since April 2021.

The Impact of Evergrande’s Liquidation

On the other hand, China’s economy faced a setback with the liquidation order for Evergrande – now known as the world’s most heavily indebted real estate developer.

The fallout from Evergrande’s collapse has created a ripple effect, impacting the property industry and causing financial instability within and outside China.

Regulatory Response

Chinese regulators have expressed confidence in containing the global shockwaves rippling out from Evergrande’s failure.

Divided Opinions

As Bove’s prediction gains attention, the financial world remains divided over the trajectory of the global economic landscape.

While Bove has a good track record, the contrasting economic performances of the United States and China suggest a different path ahead. Only time will tell whether Bove’s sage forecast becomes a reality.

More From Frugal to Free…

U.S. Budget Breakthrough: A Huge Step Forward Amidst Looming Shutdown Threat

Will Easing Inflation in America Continue?

The post China’s Rise as World Reserve Currency Spells Trouble for US Dollar, Warns Richard Bove first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / fukomuffin.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.