Despite the constant and unstoppable evolution of the financial markets, Warren Buffet’s ageless wisdom still offers investors, notably the youth, invaluable insights. Read on to explore factors influencing current markets and Buffett’s lasting principles for building wealth.

The Stock Market’s Evolution

Stock exchanges continue to expand tremendously over time, but their essence remains intact.

Buffett, with his years of experience, emphasizes the markets’ consistent behavior despite the massive growth.

Information Overabundance

Today, the internet floods investors with data, unlike before and too much information can make it difficult for modern investors to observe useful insights from irrelevant details.

Comprehending Diverse Approaches

Warren Buffett emphasizes understanding the fundamental difference between speculation and investing.

While speculation focuses on rapid gains and market movements, investing prioritizes long-term growth potential and consistent returns.

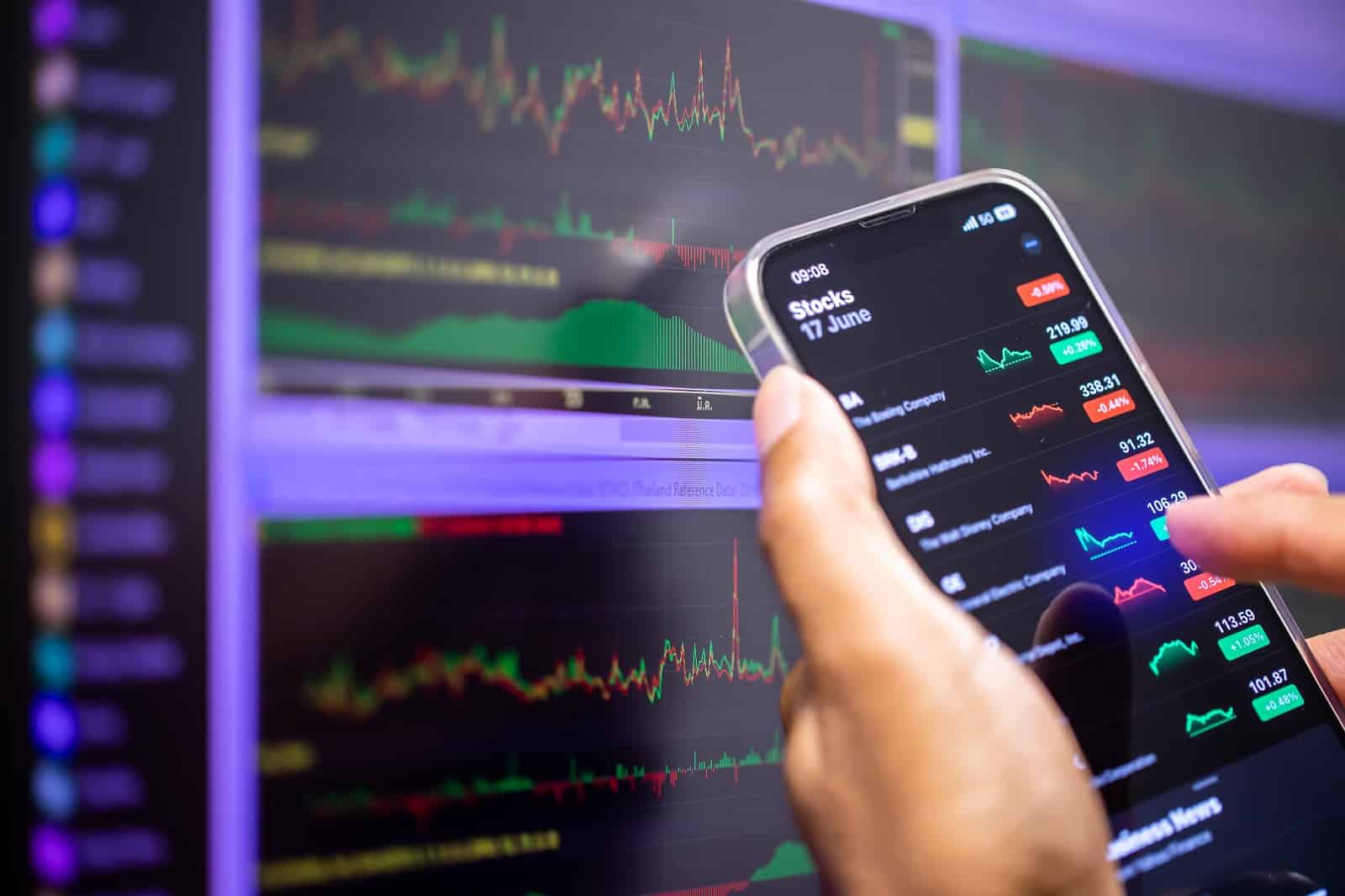

Rise of Retail Investors

Nowadays, investing apps like Robinhood make it easy for young investors to buy and sell stocks.

Warren Buffet warns against the idea of investing for fast money rather than making smart investments.

Financial Experts Attract Attention

Financial experts sometimes make unsubstantiated predictions to get people hooked on their content.

Warren Buffett doesn’t trust forecasts about the stock market – and neither should you!

Buffett’s Advice for Long-Term Success

Warren Buffett believes in being patient and disciplined with investing, not looking for quick profits.

He recommends putting money regularly into diverse index funds over time, which will help accumulate wealth slowly but surely.

The Temptation of Fast Money

TV, websites, and other financial media glamorize the idea of gaining wealth rapidly through speculation.

Warren Buffett advises you to intentionally go against the status quo and opt for the steadfast investment approach.

Wall Street’s Hidden Agenda

Wall Street thrives on promoting frantic market activity for increased customer profitability.

Buffett warns against the rise in speculative practices and cautions you to steer clear of Wall Street’s alluring marketing strategies.

Media Sensationalism: A Diversion from Wise Investing

Many financial media outlets often sensationalize speculative investments like cryptocurrency.

However, this approach directly contradicts Warren Buffett’s time-tested investing philosophy, which emphasizes consistency and patience as essential virtues.

Buffett’s Simple Yet Effective Strategy

Warren Buffett’s investing approach involves investing in high-quality companies for the long term, allowing the power of compounding to work its magic over time.

The Enduring Value of Patience

Buffett’s philosophy underscores the importance of patience in building sustainable wealth.

While the temptation of quick gains can be alluring, true and lasting wealth accumulation is achieved through consistent, disciplined investing over the long run.

Adopting a Long-Term Perspective

Once, Jeff Bezos had a conversation with Warren Buffett regarding his straightforward investing approach.

Buffett said “…not everyone is eager for the gradual path to financial growth,” highlighting the significance of maintaining a long-term investment outlook.

Harnessing the Compounding Effect

Buffett’s wisdom reflects the power of compounding in wealth accumulation. By holding onto quality investments for an extended period, you not only grow your money but exponentially multiply it through the compounding of returns.

Emphasizing Patience Over Risk-Taking

Buffett’s strategy revolves around consistency over risky gambles. He emphasizes thoroughly analyzing companies and, most crucially, exercising patience.

The Essence of Margin of Safety

Warren Buffett emphasizes the importance of the margin of safety when investing.

This principle involves purchasing assets at prices significantly below their actual worth to reduce risks and boost potential gains.

There’s Great Power in Value Investing

Warren Buffett advocates for identifying undervalued companies with strong fundamentals and holding them long-term.

By focusing on intrinsic value rather than short-term market changes, investors can capitalize on opportunities for sustainable growth and wealth accumulation.

Acknowledge Market Realities

While modern markets may exhibit casino-like behavior at times, Buffett’s principles remind us of the enduring value of patient, disciplined investing.

By focusing on long-term fundamentals, investors can resiliently weather market fluctuations.

Embrace Long-Term Growth

Buffett’s focus on long-term growth resonates strongly in a world driven by short-term gains.

Patient investors reap the rewards of steady, compounded returns by staying consistent.

Grasping Market Forces

Understanding the factors influencing asset values is key to thriving in today’s ever-changing markets.

Adapting to trends and staying informed allows you to make smart choices aligned with your long-term financial goals.

Equipping Future Leaders

As we reflect on Buffett’s investing wisdom, we must empower future generations with the necessary tools to navigate financial markets.

Instilling patience, discipline, and informed decision-making shapes a brighter financial future for all.

Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

The latest Biden administration rule on 401(k) plans is reshaping how employers manage retirement plans. It’s a complex scenario requiring a fresh understanding of fiduciary duties and provider relationships. This rule aims to protect employees but also imposes new responsibilities on employers. Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Elon Musk is calling for prosecutions after the text for a new senate bill on immigration was released. Musk accused the new bill of “enabling illegals to vote.” Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

With increasing numbers of migrants arriving in Colorado, public officials have rejected any notion of the state becoming a sanctuary for migrants and asylum seekers. Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Disney is set to appeal its refusal for a lawsuit against Ron DeSantis, who stripped the company of its rights for disagreeing with the Governor’s views on the teaching of sexual orientation in classrooms. Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

An unprecedented surge in health plan enrollments has reignited former President Donald Trump’s commitment to dismantling the program should he secure the GOP nomination once again. Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

The post Warren Buffet’s Words of Wisdom to Gen Z Investors first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / Kent Sievers.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.