Inflation has put a stranglehold on the finances of Americans, and many find themselves trying to stretch their dollars as far as they can before payday hits. To alleviate some financial stress, people have used clever tricks to keep more cash in their wallets. Use these hacks daily to save some of your money.

1. Learn To Cook

At the end of the month, when you go over your finances, add up the total cost of eating out. It can be a staggering blow to your bank account. Those service fees and tips add up fast. Learning how to cook and meal prep for yourself can be rewarding, healthy, and a great way to save money every month.

2. Buy in Bulk

Membership stores like Costco and Sam’s Club are your best friends when you want to save on everyday household items. They offer huge discounts on items you use every day, like toilet paper, toothpaste, paper towels, and so much more. Those savings add up when you buy them once every few months rather than every few days or weeks.

3. Use your Freezer

If you have a freezer, you have a ticket to savings. Bulk foods can be frozen for use later in the month. As we mentioned about buying in bulk, the money you will be saving can be used towards other needed items. No more throwing away leftovers.

4. Buy Generic

I’m not saying to give up on your favorite brands, but often, grocery stores have the same quality products as the fancy, expensive brands. Compare products like seasonings, canned goods, condiments, and cereals. You’ll be surprised by the savings.

5. Plan your Snacks Ahead

My mom was the best at this. If you are spending a day out and about, you will be bombarded by places selling food and drinks. Keep a cooler in the car with pre-made sandwiches, snacks, and bottles of water or juice. Avoid the mini-marts with pricey candy and sodas. These are better for you anyway.

6. Make Coffee at Home

It might be hard to avoid the coffee shop run when you are on the go, but a few extra minutes in the morning can save some serious dollars at the end of the month. That daily $5 cup of coffee could be used for other monthly needs. Slowing down in the morning to brew your coffee can also have mental health benefits.

7. Avoid Alcohol

Alcohol can be a pricey beverage. You don’t necessarily need to give up the booze, but if and when you go out, drink fiscally. Find the local deals. Most bars have discounted beers or spirits daily. If that isn’t your preference, avoid top shelf and drink cheaper liquor to save money on your night out.

8. Walk or Bike

Walking or biking can be a great way to save gas if you live in a city with local amenities. Plus, it will get you out enjoying the sun and getting some exercise. You might even find that you don’t even need a car. That’s a lot of money saved right there!

9. Quit Smoking

I know this one is harder than it looks, but it might be time to quit expensive addictions. Cigarettes can cost upwards of $10 a pack, depending on where you live. Think of what an extra $10 a day or two could do to help with your finances — that could be spent on groceries and other bills.

10. Public Transportation

Suppose you want to avoid paying the monthly car payments and services that come with owning a car. In that case, most cities have reliable public transportation. Enjoy your free time on the bus catching up with your reading or a podcast while you save some money. Plus, you will be lowering your carbon footprint.

11. Add a Roommate

If you are younger, this is a better option than those with a family. But, if you are a single, younger individual, it might be beneficial to add a roommate to your apartment. You can enjoy the camaraderie and friendship by having a friend next door. Make sure you pick the best one possible, as you will live with them.

12. Turn Down the Heat

If you are living in a place where the temperature drops below zero, I don’t recommend this tactic. But if you live somewhere where it gets in the 50s, you can leave that heat off. Put on a sweater or grab a blanket. It’s cozier that way, anyway. Plus, the heating bill will be lower at the end of the month.

13. Use the Library

Are you a reader? Are you a movie buff? The public library should be on your list of places to go this weekend. You can literally borrow books and DVDs for free. Books cost around $25 these days, and if you don’t have a lot of room to store those books on a shelf, you can just send them back. I hate clutter, so having all the books on my shelves gone is appealing to me.

14. Plan your Entertainment

Many big cities have many free or cheaper options to keep you entertained on the weekends. Movie theaters have a matinee option for movies at a discounted rate. Many museums will have free entry or a discounted rate during peak times. Find some free performances in the local downtown areas. You can walk around and be entertained at the same time.

15. Coupons

Yes, coupons are still a thing. I remember my mom having a giant Rolodex of coupons and a filing system that was hard to navigate. It’s much easier now; most grocery store chains have coupons digitally on their apps. Places like Target, Walmart, and all other major grocery stores offer weekly coupons you can redeem on your next visit.

16. Exchange Nights at Home

One of the best ideas to maintain your social life and save some money is to exchange game nights at home with your friends. Why spend money at a crowded bar when you can gather with your friends and challenge each other to board and card games? After all, going out is meant to be fun. What’s more fun than a night in with your friends?

17. Stay Away From Debt

These are words to live by, but if you do have credit card debt, don’t panic. First off, if you don’t need a credit card, don’t get one. The fees are insane. But, if you do have debt, make sure you find a way to pay off more than the minimum balance. This will save you hundreds, if not thousands, in the long run.

18. Bundle the Services

If you are paying separately for internet, phone, and cable, you are doing it wrong. There are some great deals from providers out there that you can save money on all of these services. You might even be able to add cable to your bill to save even more money.

19. Conserve Electricity

Electricity costs can creep up on you in an instant. Try turning off appliances at night and be adamant about keeping unnecessary lights off when not needed. These “vampire costs” come from appliances plugged in that use power when not in use. Cut that unnecessary cost away — you don’t need it.

20. Learn Home Repairs

One of the most important things in home ownership is knowing the cost of the necessary repairs. Learn how to do your own maintenance. There are online tools to teach you basic repairs that will save you money from hiring a contractor, and you can feel good about yourself afterward.

21. Use your Credit Card Rewards

I know I said credit cards may be detrimental to savings, but they can also help. Some credit cards offer fantastic cash-back rewards. If you have a card that pays you back on groceries or gas, use it. Just remember to pay off the balance to avoid the fees and debt.

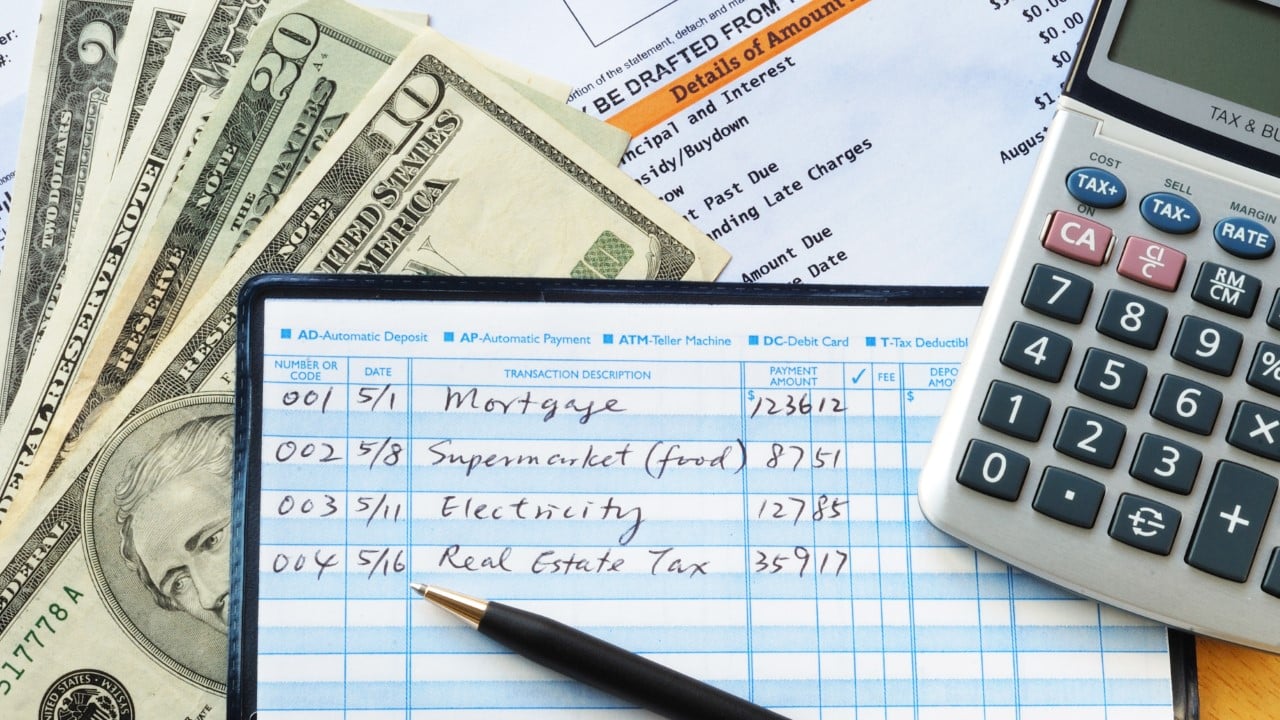

22. Set a Budget

Sometimes, writing down all of your expenses can help you stay on track financially. For example, setting up a weekly menu you plan to cook can keep you focused on items you need or don’t need while shopping. It can also limit waste on expensive produce. You’ll know how much you’re spending, and you’re actually using what you’re buying.

23. Cancel Costly Subscriptions

Remember that one show you loved, so you bought a recurring subscription to that one streaming service? You haven’t opened that app in months, and the bills keep coming. What other apps do you pay for and not use? Check your monthly subscriptions and cancel whatever you don’t need.

24. Refinance

If you have equity in your assets, like your home or car, you can refinance to save some money every month. Maybe you can get a better interest rate on your vehicle for a lower payment or lower your mortgage with a new home loan. Talk to a lender to see if this is a viable option or not. It could save you a fortune!

More From Frugal to Free…

U.S. Budget Breakthrough: A Huge Step Forward Amidst Looming Shutdown Threat

Will Easing Inflation in America Continue?

The post Inflation Survival: Money-Saving Tips to Stretch Your Dollars first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / Drazen Zigic.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.